Rippling

Rippling’s online payroll software has a user-friendly interface and requires little training for new users. The software works with over 500 third-party applications to improve your payroll process, tax preparation and other business operations. The payroll process is so simple that you can run it in as little as 90 seconds.

The software tracks important metrics like total hours worked per employee, paid time off and labor expenses. You can set up direct deposits directly in Rippling or give employees paper checks. The software automatically deducts an employee’s tax withholdings based on their filing status, and it automatically files international taxes.

Rippling advertises a price of $8 per person per month but requires custom quotes for the base fee.

Read our Rippling review for more information.

JustWorks

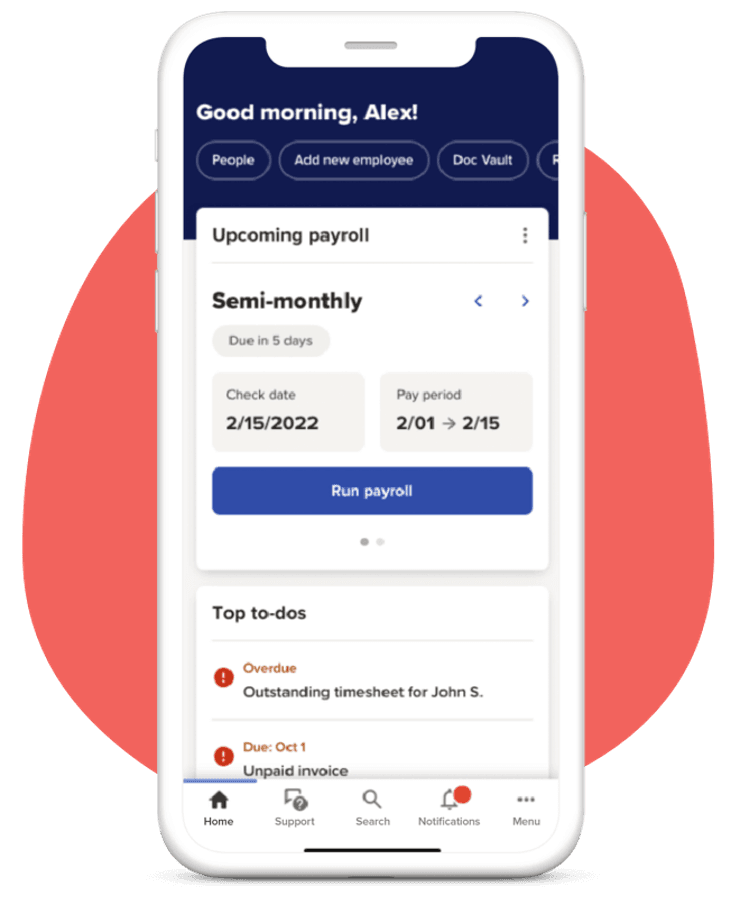

Outsourcing payroll and HR services to a professional employer organization (PEO) can help your company save on benefits and payroll expenses. Justworks offers an affordable and comprehensive solution with robust online payroll services, employment practices liability insurance, and seamless accounting software integrations. Its high-quality health insurance options and built-in time-tracking tools make it our top choice for PEO services.

Justworks’ pricing starts at $59 per employee per month, which is higher than standard payroll software solutions. However, by acting as your PEO and co-employer, Justworks provides access to a 24/7 customer service team available via Slack, phone, email, chat, and text, ensuring continuous support for your business needs.

Zenefits (formerly TriNet)

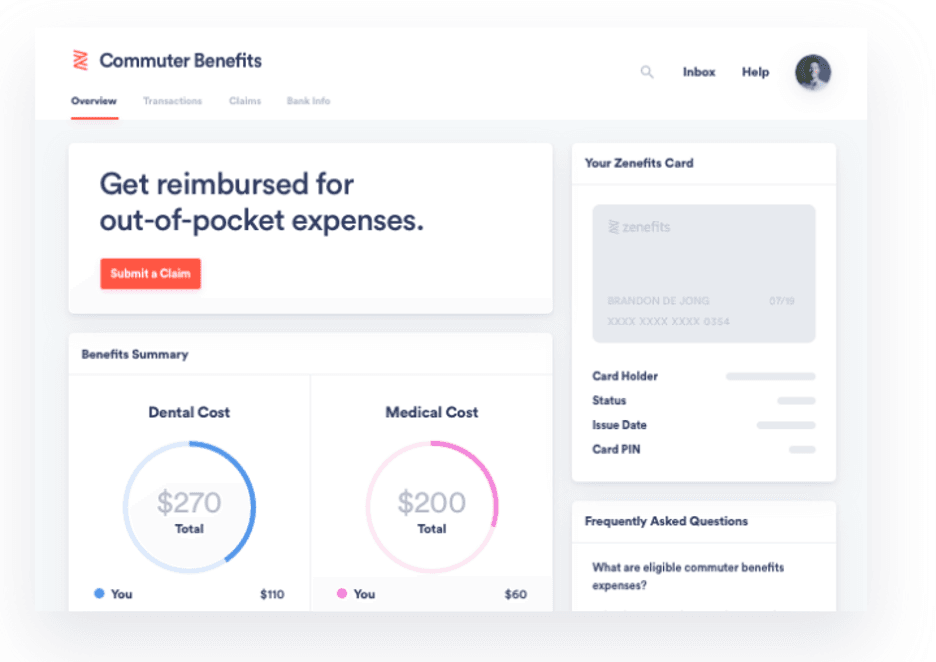

Zenefits Payroll is a smartly presented software platform that can run payroll in just three mouse clicks. It offers all the core functionality we look for in our review of payroll services at a highly competitive cost. There’s extensive report functionality, including pre-prepared reports, while niche features include reported tips and assistance with child support remittance. Part-month payments are automatically prorated, dynamic pay stubs can be personalized with messages, and workers are able to view documents even after they’ve left the company to work elsewhere.

In terms of pricing, Zenefits offers modular packages that can be built on one of three base plans, which range from $8 to $21 per month, plus $6 per employee per month.

Read our Zenefits review for more information.

The full Zenefits HR platform integrates seamlessly with TriNet Zenefits. Source: TriNet Zenefits

Papaya Global

If you plan to expand your business globally, Papaya Global is a great option for payroll processing. The vendor can run payroll in more than 160 countries for all types of employment. That’s why it’s used by large brands like Microsoft, Toyota and Shopify.

The company’s employer of record service ensures that you stay compliant with the various employment laws in all the countries where you have workers. Papaya Global will even help you secure short-term or long-term work permits for employees outside their home countries.

Papaya Global doesn’t charge a base fee for running payroll; the payroll package simply costs $25 per employee per month.

Read our Papaya Global review for more information.

Heartland

Not all online payroll services offer prompt responses when issues arise, but Heartland Payroll stands out by providing on-demand access to professionals who can address your questions about payroll tax preparation and labor laws. Its HR Support Center features Ease and Employee Navigator, which streamline new-hire reporting and benefits-related payroll deductions. With a comprehensive payroll solution and extensive HR resources, small businesses can avoid manual data entry errors and stay current with the latest regulations. That’s why we consider Heartland Payroll the best payroll software for HR support.

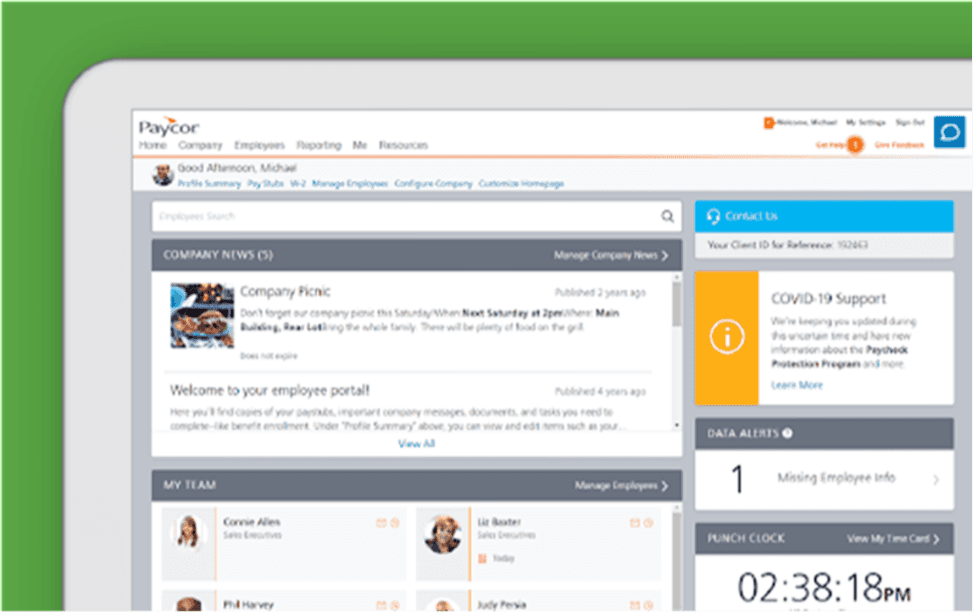

Paychex

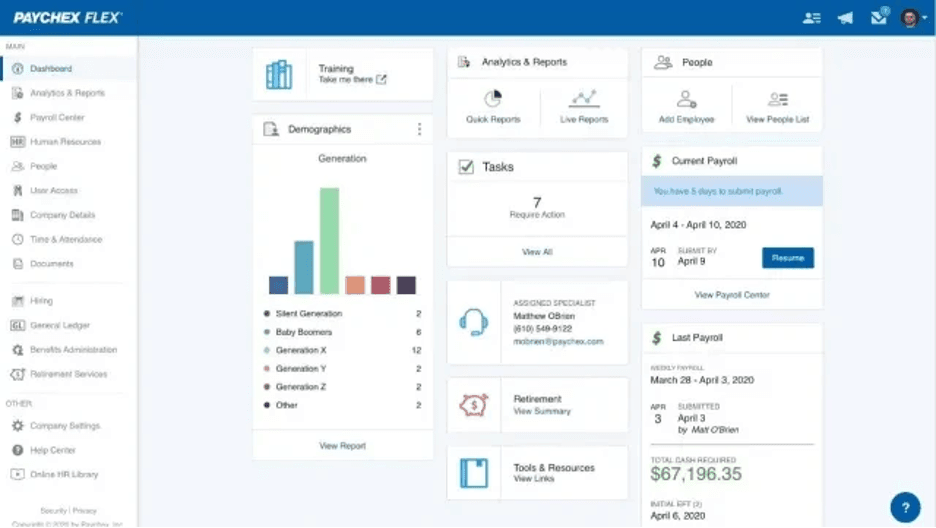

Paychex is a payroll service that’s a great option for businesses of all sizes. The company offers weekly, biweekly, semimonthly and monthly payroll schedules. Paychex can accommodate all types of workers, including full-time and part-time employees, 1099 contractors, and freelancers. Team members can choose to receive their paycheck as a direct deposit, paper check or prepaid debit card.

Paychex offers three packages, which start at $39 per month, plus $5 per employee per month.

Read our Paychex payroll review for more information.

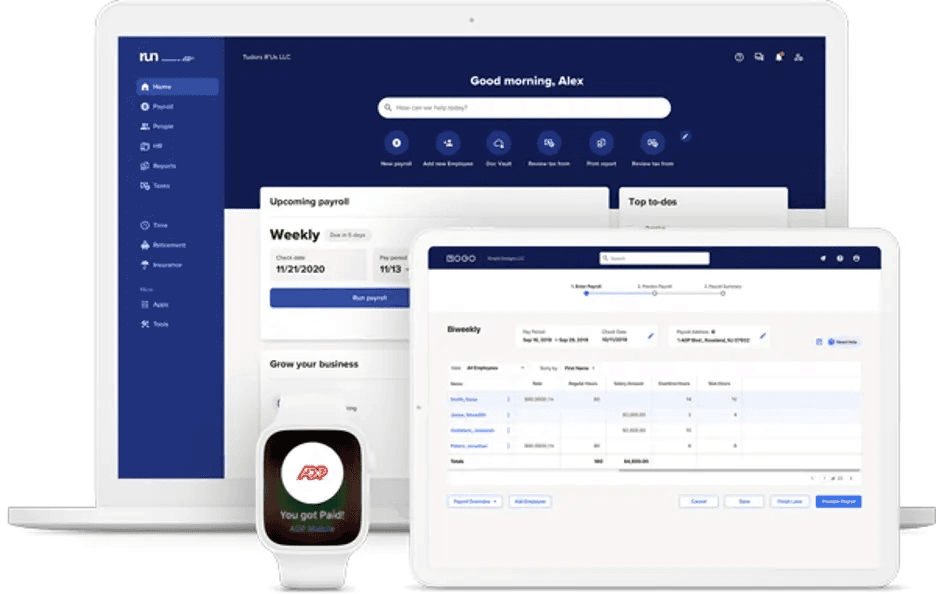

With Paychex, you can access both HR and payroll solutions. Source: Paychex