Don’t count the accounts payable (AP) aging report out. In these uncertain times, this oft-overlooked accounting method can alert you to cash flow problems and protect your bottom line.

Most small business owners only worry about their cash going in and out, giving little thought to how much they pay over time. It’s a popular way to operate, but it’s also a surefire way to run into cash flow problems if an unexpected bill is due. A more effective way to run your business and protect your cash flow is through the AP aging report.

Editor’s note: Looking for the right accounting software for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs.

What is an AP aging report?

An AP aging report summarizes the money a business owes to vendors and suppliers. It lays out when payments are due, how much your balance is and whether you can save money by paying early or protect your cash flow by paying later. These reports help businesses improve their billing practices and forecasting accuracy, making tracking what you owe less overwhelming.

“[An accounts payable report] tells you how much you need to satisfy your debt obligations,” explained Dawn Brolin, a certified public accountant and owner of Powerful Accounting. “It helps with forecasting to make sure you can stay in business.”

AP represents the money you spend to operate your business. This money pays vendors and suppliers weekly, monthly, quarterly or annually.

What is included in an AP aging report?

Most top accounting software solutions can easily create AP aging reports. An AP aging report can be as unique as the business creating it but the following categories are found in most:

- Vendor name

- Amount owed

- Due date

- Payment terms

- Past due accounts

These reports give you a visual aid to assess your outstanding debts and flag late ones. Typically, the report is organized in 30-day groups so you can see what is due in the current month and future periods easily. It can be customized to include vendors with one-week or two-week due dates. If done right, the AP aging report should show you any upcoming due dates quickly.

What are the benefits of using an AP aging report?

Some small business owners may not think AP aging reports are crucial. After all, who has time to pay bills, let alone track what is owed a few months from now? However, this report can bring significant benefits, including the following.

1. AP aging reports improve cash flow management.

Cash is the fuel that keeps businesses running yet managing it can be one of the most challenging aspects of operating an organization. An AP aging report can be a crucial tool for creating cash flow strategies that improve cash flow management. You’ll know when bills are due, so you can pay them on time and avoid any penalties or pay earlier to get a discount from the vendor. AP aging reports help business owners avoid surprises that hurt their cash flow and bottom line.

“Cash coming in and coming out does not tell you the full story you need to manage your accounts,” cautioned Ben Richmond, country manager at Xero. “Managing accounts payable is an important part of managing cash flow.”

An AP aging report can also help you avoid damaging your business’s reputation. If you consistently pay late, vendors may not be willing to extend credit or worse will balk at doing business with you in the future. That impacts cash flow and your business’s ability to thrive.

“You want to build relationships with suppliers,” Richmond explained. “Often, for those who are paying late without notice or without any conversation, suppliers tighten the terms of trade.”

2. AP aging reports facilitate supply chain management.

AP aging reports help you understand your vendors and suppliers better. This benefit may not be crucial for large national companies with massive buying power, but it can be enormously valuable for small businesses. Your aging report can help you identify vendors willing to give you early-payment discounts, those who don’t mind if you’re late and those open to negotiating better terms.

The AP aging report can also help you prioritize bills. Not all vendors send out invoices every 30 days. With an AP aging report, you can categorize your bills based on due dates, prioritizing the ones that must be paid first.

3. AP aging reports help with budgeting.

AP aging reports help you budget for your small business. You’ll have access to insightful historical data on your spending and debt. You’ll be able to determine if you rely too much on credit and can pinpoint opportunities to negotiate more favorable terms.

“It’s a really useful tool when paying 30 days or longer,” Richmond noted. “It helps you make sure you don’t miss paying someone on the agreed-upon date.”

Other helpful

accounting reports include balance sheets, profit and loss statements and accounts receivable (AR) aging reports

What is an example of an AP aging report?

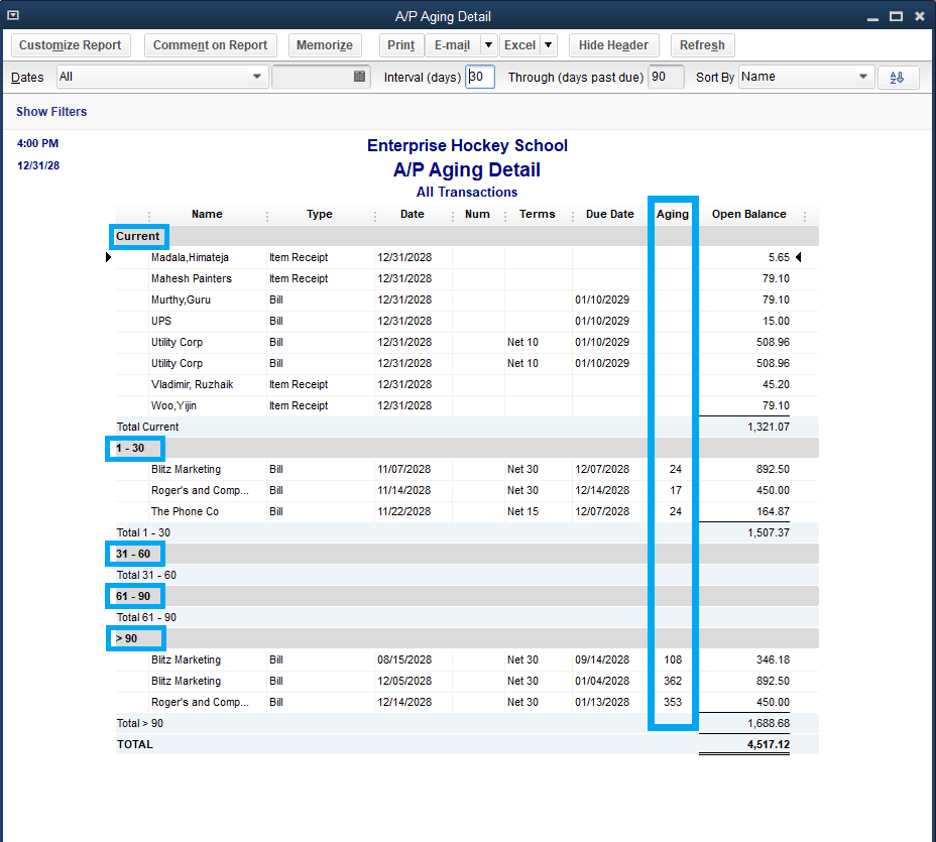

AP aging reports can look different for various businesses, although they should include all the necessary information. Here’s an example of an AP aging report from QuickBooks:

Source: QuickBooks

What is the difference between an AP aging report and an AR aging report?

AP and AR are both crucial aspects of accounting. AP aging reports and AR aging reports both provide a visual representation of what is due now and what is due soon. The difference is that AP aging reports focus on what you owe and AR aging reports focus on what others owe you.

AR aging reports should include details about the amount customers owe you, when it is due, how late a payment is and what discounts you offer for a faster payment.

How do you create an AP aging report?

You can create AP aging reports manually or via accounting software:

- Manual AP aging reports: Creating, tracking and updating AP aging reports manually can be time-consuming. If you go this route, you must enter detailed invoicing information along with AP information carefully. “Looking at the terms and date on invoices isn’t enough,” Brolin warned. You must ensure you don’t miss payment discounts or forget about late charges.

- Accounting software-created AP aging reports: Fortunately, accounting software automates the process of creating AP aging reports. Most full-featured accounting platforms can generate these and other accounting reports automatically. You can upload invoices, customize fields and set alerts easily when bills are due. You’ll gain a comprehensive view of your cash flow now and in the future. “[Accounting software] saves time and human error,” Brolin said.

When

choosing accounting software, consider a platform's cost, usability and feature set. You don't want to pay for more than you need or encounter a steep learning curve.

Best accounting software for managing AP

The right accounting software can help you generate AP aging reports and stay on top of all your small business’s financial concerns. Here are a few of our choices for the best accounting software platforms for AP aging reports and other features:

- Xero: Xero is an excellent, affordable platform that excels at helping business owners track and pay bills. As we explain in our Xero review, the solution’s dashboard provides a centralized overview of what’s due and when, so you never miss a payment. This feature helps you avoid costly late fees and boost your business’s credit score.

- Intuit QuickBooks Online: Most QuickBooks Online accounting software plans include essential bill management features. Except for the Simple Start plan, you’ll also get access to enhanced accounting report features. Read more about bill payment options and other features in our Intuit QuickBooks Online review.

- Zoho Books: This platform’s online payment integration is exceptional and will help business owners pay and manage bills. Our Zoho Books review highlights this platform’s incredibly user-friendly interface that makes setting up bill payments, expenses and banking information a breeze.

AP aging reports give you the full picture

When trying to manage your cash flow effectively, don’t forget about the AP aging report. It’s an added step, but it can help you prioritize your bills, budget and forecast and keep your operations humming. The right accounting software can help you streamline aging reports and other essential AP and AR tasks. Once the aging report is integrated into your AP process, the answers to your cash flow questions are just a few clicks away.

Natalie Hamingson contributed to this article.