Independent contractors work for themselves; the companies they work with don’t technically employ them. Independent contractors submit invoices for their work and are subject to self-employment tax. The paying company doesn’t deduct tax from their payments. Independent contractors bring employers scheduling flexibility, fewer tax obligations and straightforward working relationships.

More small businesses are using independent contractors than ever, preferring outside consultants and freelancers over hiring full-time or part-time employees. However, before entering into an independent contractor arrangement, employers must understand how this worker classification differs from that of a traditional employee and what they need to do to comply with U.S. Department of Labor (DOL) and IRS regulations.

How do independent contractors differ from employees?

Independent contractors differ from traditional employees who’ve gone through a company’s hiring and onboarding process. The company pays its contractors, but contractors aren’t employees. Instead, independent contractors are self-employed (also known as a “business for self”); they can operate and work for several clients simultaneously.

Companies often use independent contractors to avoid hiring staff for short-term needs.

How do independent contractors and employees differ?

The DOL and IRS maintain crucial definitions and rules for independent contractor status:

- IRS: The IRS considers an individual to be an independent contractor if the payer controls only the body of work’s results – not necessarily how it’s completed. The independent contractor completes IRS Form W-9, and an employee completes the IRS W-4 tax form.

- DOL: The DOL looks at the type of work and the degree of control over the work when determining if someone is an independent contractor. It also looks at the worker’s opportunity for profit and loss, the relationship’s permanency, and more.

Here are some basics about independent contractors vs. employees.

Independent contractors

Independent contractors are self-employed; the money they make working as independent contractors is subject to self-employment tax. They supply their own work tools and must submit invoices for payment.

Employees

Employees perform services an employer controls, including what work must be done and how it should be completed. This definition also applies to exempt employees, who have the autonomy to operate within their role as the employer sees fit if the outcome is acceptable.

What matters to the DOL is whether the employer has the legal right to control the details of how and when services are performed.

Here are some quick facts about employees:

- An employee can’t also be an independent contractor for their employer.

- Employee earnings are generally not subject to self-employment tax.

- Employee earnings may be subject to FICA (Social Security tax and Medicare) and income tax withholding, which the employer typically takes out during payroll processing.

- The employer provides work-related tools and the necessary gear.

- Although employees may fill out timecards, they do not submit monthly invoices for payment.

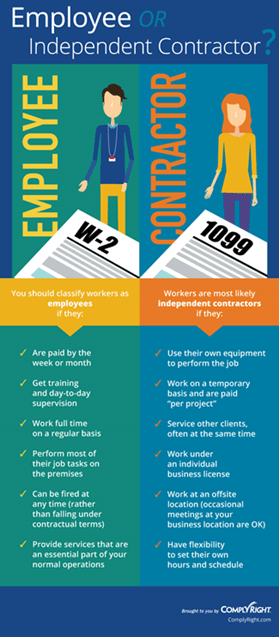

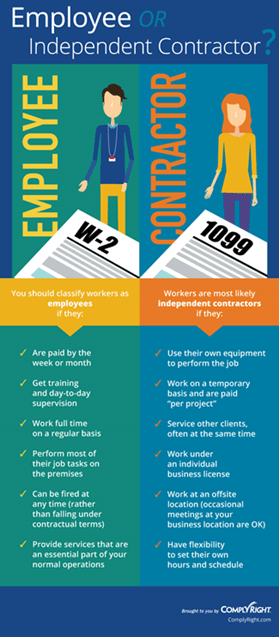

ComplyRight’s chart below shows the stark differences between independent contractor and employee classifications.

Source: ComplyRight

How can you avoid misclassifying independent contractors?

Misclassifying independent contractors can get employers in big trouble with the DOL and IRS. It’s critical to classify all your workers accurately. If you misclassify a worker, you could be subject to substantial penalties and fines.

In the past, the IRS used a 20-factor test to help businesses determine if someone was an independent contractor or employee. The agency has now compressed these 20 factors into three categories:

- Behavioral control: Can the business direct and control what work is done and how it’s accomplished?

- Financial control: Does the business direct or control the financial aspects of the worker’s job?

- Relationship of the parties: Does the business provide benefits? Are there written contracts or oral agreements about the work arrangement?

While the IRS no longer uses the 20-factor test to determine someone’s worker classification, it’s still helpful to look at the factors it evaluates. (Note that no specific number of factors determines a classification.)

- Level of instruction: If the company directs when, where and how work is done, this indicates a possible employment relationship.

- Amount of training: Asking workers to undergo company-provided employee training suggests an employment relationship since the company directs the methods by which work is accomplished.

- Degree of business integration: Workers whose services are integrated with the business operations or significantly affect the business’s success are likely to be considered employees.

- Extent of personal services: Companies that insist on a particular person performing the work assert a degree of control that suggests an employment relationship. In contrast, independent contractors are typically free to assign work to anyone.

- Control of assistants: If a company hires, supervises and pays a worker’s assistants, this control indicates a possible employment relationship. If the worker retains control over hiring, supervising and paying helpers, this arrangement suggests an independent contractor relationship.

- Continuity of relationship: A continuous relationship between a company and a worker indicates a possible employment relationship. However, an independent contractor arrangement can involve an ongoing relationship for multiple, sequential projects.

- Flexibility of schedule: People whose hours or days of work are dictated by a company are likely to qualify as its employees.

- Demands for full-time work: Full-time work gives a company control over most of a person’s time, supporting a finding of an employment relationship.

- Need for onsite services: Requiring someone to work on company premises – particularly if the work can be performed elsewhere – indicates a possible employment relationship.

- Sequence of work: If a company requires work to be performed in a specific order or sequence, this control suggests an employment relationship.

- Requirement for reports: If a worker must provide regular written or oral reports on the status of a project, this arrangement indicates a possible employment relationship.

- Method of payment: Hourly, weekly and monthly pay schedules are characteristic of employment relationships unless the payments are a convenient way of distributing a lump-sum fee. Payment on commission or project completion is more characteristic of independent contractor relationships.

- Payment of business or travel expenses: Independent contractors typically bear the cost of travel or business expenses, and most contractors set their fees high enough to cover these costs. A company’s direct mileage reimbursement or reimbursement of travel and other business costs suggests an employment relationship.

- Provision of tools and materials: Workers who perform most of their work using company-provided equipment, tools and materials are more likely to be considered employees. Work primarily done using independently obtained supplies or tools supports an independent contractor finding.

- Investment in facilities: Independent contractors typically invest in and maintain their own work facilities. In contrast, most employees rely on their employers to provide work facilities.

- Realization of profit or loss: Workers who receive predetermined earnings and have little chance to realize significant profit or loss through their work generally are employees.

- Work for multiple companies: People who simultaneously provide services for several unrelated companies are likely to qualify as independent contractors.

- Availability to the public: If a worker regularly makes services available to the general public, this supports an independent contractor determination.

- Control over discharge: A company’s unilateral right to discharge a worker suggests an employment relationship. A company’s ability to terminate independent contractor relationships generally depends on contract terms.

- Right of termination: Most employees can terminate their work for a company without liability. Independent contractors cannot terminate services without liability, except as allowed under their contracts.

The IRS generally assumes a worker is an employee on a company's

payroll unless the company proves otherwise. The burden of proof is on the employer to show that the worker is classified correctly.

What are typical examples of independent contractors?

There are many routine examples of independent contracting functions or roles within business today, including the following:

- Freelance writers and graphic designers: Freelance writers generally work as independent contractors, writing articles and then selling the articles to publications. Similarly, freelance graphic designers may create graphics for many companies’ one-off projects. The work product is outlined in an agreement and completed how the freelancer sees fit. The company compensates the freelancer per task.

- Real estate agents: Typically, real estate agents work independently. However, they often work within a more extensive network or agency that helps process commissions in exchange for shepherding a sale.

- IT professionals: Some IT professionals are independent contractors. This can be a tricky one, as many IT professionals are employees. If they are performing short-term or specific project work with a completion timeline, they typically operate within an independent contractor role.

What are best practices for working with independent contractors?

When working with independent contractors, use these strategies to keep yourself out of hot water with the IRS while ensuring the work meets your needs:

- Don’t treat independent contractors like employees. It’s essential not to blur the lines between contractor and employee. Don’t allow independent contractors to use company equipment they should already have. For jobs like writing and graphic design, contractors generally do not work on-site.

- Use a written contract. Never allow a contractor to begin work on behalf of your company without a fully executed contract or agreement. This document outlines your relationship with the independent contractor; it’s essential to stick to its parameters throughout your relationship.

- Do not allow grossly extended timelines. This is an all-too-common mistake the IRS finds employers making with independent contractors. If you need long-term work from the contractor, the DOL and IRS will eventually wonder if you should have a regularly scheduled employee in that role.

If you're concerned about managing independent contractors, consider implementing one of the

best employee monitoring software programs, which typically have a freelance mode to keep tabs on remote contracted workers' productivity.

What are the pros and cons of using independent contractors?

Working with independent contractors has many upsides for businesses. However, there are also some downsides to consider.

Pros

- Lower overhead: While an independent contractor’s hourly rates often far exceed what you’d pay an employee, the contractor is responsible for their overhead costs, including equipment, supplies and workspace. You are not responsible for providing training, health insurance, benefits, vacation time and pay, unemployment insurance, or workers’ compensation. The contractor pays their own FICA taxes. They also provide you with an invoice, so you don’t have to go through your payroll department.

- Expertise: An independent contractor is generally an expert with a specialized skill set in their area; for example, writing, design or IT. You don’t have to invest in employee training; the contractor can generally hit the ground running. This is especially useful for short-term projects, where costly in-house hiring and training may not address a long-term need and would cost more than the training’s enduring value.

- Flexibility: When your current contract ends, you can opt to offer another project to the independent contractor or make no further offers if it’s not a good fit. If you like the contractor’s work, you can offer them more projects on a schedule that suits your business. In contrast, ending an employee relationship is far more complex.

Cons

- Retention: Independent contractors typically work on multiple projects from multiple businesses in the same time frame; they may not be available precisely when you need them. Also, however much you like their work, a contractor can decide it’s not a good fit. And because a contractor is typically not working on-site, they’re unlikely to feel the same investment in your business as an employee.

- Copyright ownership: Unless it’s specified in your contract, any work a contractor does on your behalf may not be your legal property. Review copyright laws and structure your contracts to reflect any legal claims to the work product.

- Potential legal liabilities: If the IRS, DOL or another governing body suspects that a contractor’s work should fall under the “employee” category, you may be audited. Also, because you’re not providing workers’ compensation coverage to a contractor, if they’re injured in the course of contract duties, there’s potential for a liability lawsuit.

Contractors are a smart business solution – if you get it right

Hiring an independent contractor can be a cost-effective way to meet nonrecurring business needs or accomplish tasks a full-time employee can’t. If you’re careful to follow IRS and DOL rules, an independent contractor can be an excellent addition to your business team.

Ross Mudrick contributed to the writing and reporting in this article.