MENU

Start

- Best Small Business Loans for 2024

- Businessloans.com Review

- Biz2Credit Review

- SBG Funding Review

- Rapid Finance Review

Our Recommendations

- 26 Great Business Ideas for Entrepreneurs

- Startup Costs: How Much Cash Will You Need?

- How to Get a Bank Loan for Your Small Business

- Articles of Incorporation: What New Business Owners Should Know

- How to Choose the Best Legal Structure for Your Business

Our Guides

- Business Ideas

- Business Plans

- Startup Basics

- Startup Funding

- Franchising

- Success Stories

- Entrepreneurs

Small Business Resources

Grow

- The Best Credit Card Processors of 2024

- Clover Credit Card Processing Review

- Merchant One Review

- Stax Review

Our Recommendations

- How to Conduct a Market Analysis for Your Business

- Local Marketing Strategies for Success

- Tips for Hiring a Marketing Company

- Benefits of CRM Systems

- 10 Employee Recruitment Strategies for Success

Our Guides

- Sales & Marketing

- Finances

- Your Team

- Technology

- Social Media

- Security

Small Business Resources

Lead

- Best Business Phone Systems of 2024

- The Best PEOs of 2024

- RingCentral Review

- Nextiva Review

- Ooma Review

Our Recommendations

- Guide to Developing a Training Program for New Employees

- How Does 401(k) Matching Work for Employers?

- Why You Need to Create a Fantastic Workplace Culture

- 16 Cool Job Perks That Keep Employees Happy

- 7 Project Management Styles

Our Guides

- Leadership

- Women in Business

- Managing

- Strategy

- Personal Growth

Small Business Resources

Find

- Best Accounting Software and Invoice Generators of 2024

- Best Payroll Services for 2024

- Best POS Systems for 2024

- Best CRM Software of 2024

- Best Call Centers and Answering Services for Busineses for 2024

Our Recommendations

Online only. Expires 4/27/2024

Stax vs. Square: Comparing Top Credit Card Processors

Table of Contents

Your small business needs a credit card processing account to accept more than credit card payments. The best credit card processing services also facilitate payments via invoices, automated clearing house (ACH) bank transfers, digital wallets and manual entry.

Both Stax and Square, which rank among our top credit card processing vendors, offer a breadth of payment options. This makes them well worth comparing when choosing a credit card processor. To do exactly this, we dove back into the key takeaways from our Stax review and our Square review and investigated each platform’s latest updates. The results of our research are below.

Stax vs. Square Compared

CRITERIA | STAX | SQUARE |

|---|---|---|

Monthly cost | $99 or $199 per month, with custom enterprise pricing | Pay as you use; optional subscriptions from $29 to $69 per month |

Rate per transaction | 8 cents per in-person transaction; 15 cents per manually entered transaction | 2.6% to 3.5%, plus 10 cents to 30 cents per transaction |

Additional fees | $25 chargeback fee | None |

Third-party integrations | Yes, including accounting software and most point-of-sale (POS) providers | Yes, including enterprise resource planning systems and custom integrations |

Payment methods | Credit cards, contactless payment, online transactions, invoices and manual entry | Credit cards, digital wallets ACH payments, invoices and manual entry |

E-commerce and reporting | Reconciliation and transaction reports, sales metrics and inventory management | Inventory management, customer data collection and analysis, sales reports and real-time data and analytics |

Customer support | 24/7 | Weekdays, 6 a.m. to 6 p.m. Pacific time |

Who Do We Recommend Stax For?

Stax’s credit card processing solutions are designed with high-revenue businesses in mind. Its flat-rate monthly pricing and three pricing tiers are ideal for managing your credit card processing costs as your company grows. As your credit card transaction volume scales, your fees remain unchanged, lowering the overall per-transaction cost. This makes Stax especially effective if your monthly credit card processing volume is on the high end.

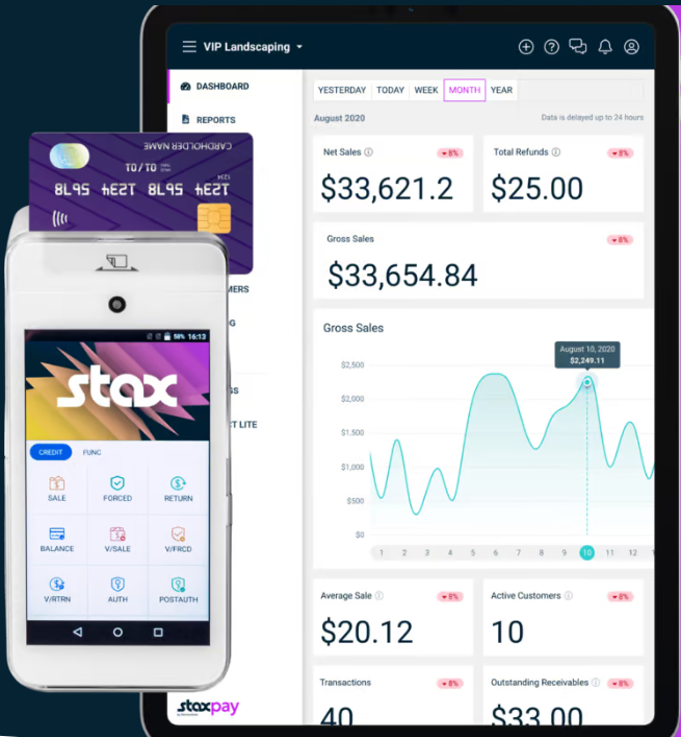

We also recommend Stax if data visualization and state-of-the-art reporting are of paramount importance to you when choosing a credit card processing vendor. That’s because all Stax plans offer dashboards and analytics. No matter your transaction volume, you can see insights into your business’s key credit card processing metrics easily.

The Stax dashboard displays your gross sales clearly in an easily digestible visual format. Source: Stax

We’ve also found Stax’s customer service and technical support to be among the most impressive that credit card processing vendors offer. No matter your transaction volume, you get 24/7 phone, email and live chat support. That’s hugely helpful, especially if your business accepts online credit card payments and you’re selling around the clock. With support similarly accessible at all times, you can problem-solve from the very moment any issues arise:

- Stax charges flat-rate pricing based on your credit card transaction volume plus a small fee per transaction.

- All Stax customers get dashboard and analytics tools and the platform’s reporting features are exceptionally advanced.

- You can get in touch with Stax for customer service or technical support at literally any time.

All Stax accounts also include transaction and customer data export, adding further to Stax’s versatility when it comes to analytics and reporting.

Who Do We Recommend Square For?

Growing and low-volume sellers alike can rely on Square. We like that Square’s pricing model is pay-as-you-go, meaning that your usage costs correspond with how many transactions you make. In other words, if your transactions are low, so are your costs and as your transactions increase, your costs increase but don’t balloon. This stays true no matter which types of payment methods you process, whether in-person credit cards or digital wallets.

Square’s pay-as-you-go structure means there’s no monthly premium to use the platform — instead, you’ll pay a small fee per transaction. Still, restaurants and retail storefronts can opt into a monthly subscription for more advanced reporting and operations features. Appointment-based businesses can also opt into a monthly “Plus” plan with advanced payment, scheduling and client management tools. A more expensive version of this plan, Premium, comes with staff management add-ons. We recommend Square for all these potential users.

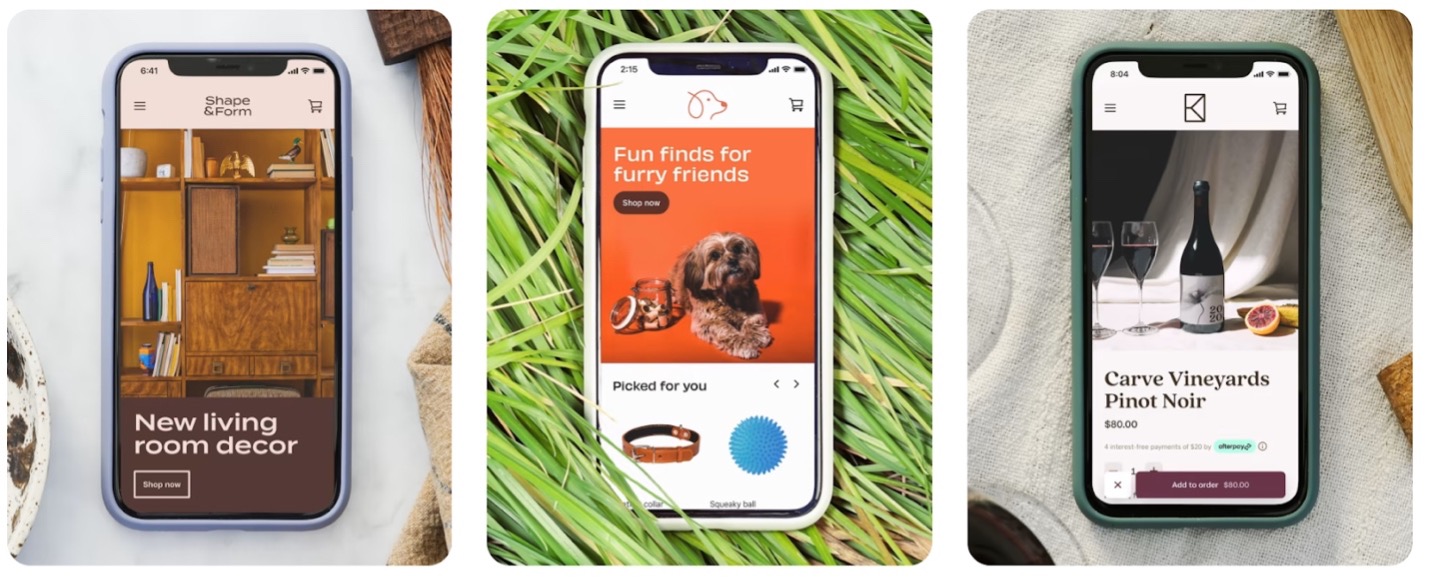

We also recommend Square for customization features, such as bespoke dashboards, online stores and third-party integrations. You can choose what you want to see on your dashboard easily and build a website where online shoppers can interface with your brand. Plus, through the Square application programming interface (API), you can enable in-person, mobile and remote payments.

With Square’s Premium plan for appointment-based businesses, you can create custom-tiered staff commission rates. This is another way in which customization features lie at the core of Square’s services.

- Square’s pay-as-you-go pricing means you only pay when you make sales, with optional monthly subscriptions and add-on features available.

- Square supports pretty much every type of customer payment, and you can meet customers where they’re at using the Square API.

- Customizable features including the API, user dashboards and online stores are part of the Square experience.

Square’s credit card processing services come with an online store builder you can use to create a clean, mobile-friendly website for your business. Source: Square

Stax vs. Square Comparison

Price and Plans

Stax

Here’s how Stax’s pricing plans break down:

- $99 per month for annual processing volume of up to $250,000

- $199 per month for annual processing volume of more than $250,000 and up to $500,000

- Custom pricing for larger annual processing volumes

We like that this pricing is easy to understand. It’s a refreshing change from the convoluted pricing plans on which credit card processing companies so often operate.

Square

Square’s pricing is pay-as-you-go, meaning there’s no monthly premium unless you opt into a special plan designed for your type of business. Without such a plan, you’ll only pay the rate per transaction — there are no additional fees. Should you seek a subscription, the following options are available:

- Plus plan for restaurants: $60 per month, per countertop POS device, with $40 per additional countertop device or $50 per mobile POS location

- Plus plan for retail businesses: $60 per month, per location

- Premium plan for eligible restaurants or retail businesses: Custom pricing

- Plus plan for appointment-based businesses: $29 per month, per location

- Premium plan for appointment-based businesses: $69 per month, per location

Winner: Square

We prefer Square’s payment model. It’s almost certainly going to be your lower-cost option when comparing Stax vs. Square — unless your transaction volume is high. In that case, we might instead recommend Stax. The flat monthly subscription can be more cost-effective than paying for each transaction as your volume increases.

Rate per transaction

Stax

Stax charges 8 cents per transaction for in-person payments and 15 cents for manually entered transactions, such as those taken over the telephone. We like this about Stax. Since there’s no percentage charged per transaction — only a flat rate — your per-transaction costs remain low and easy to calculate. Plus, with only two categories of transactions, you don’t have to remember a bunch of transaction types and rates.

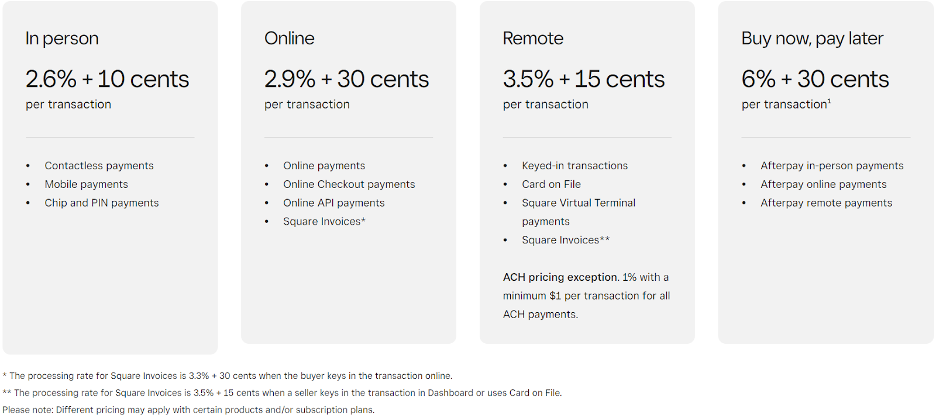

Square

Like many credit card processors, Square charges interchange fees on each transaction. This means each transaction incurs a percentage fee plus a small additional flat fee. Although standard in credit card processing, this pricing model can lead to cost confusion for the average business owner. It doesn’t help that Square charges different rates for four types of transactions, as detailed below:

- In-person credit card transactions: 2.6% plus 10 cents per transaction

- Online API, store or checkout payments: 2.9% plus 30 cents per transaction

- Keyed-in/manually entered via card on file: 3.5% plus 15 cents per transaction

- Invoice payments via ACH bank transfer, Apple Pay, Google Pay or credit card details given via phone: 3.3% plus 30 cents per transaction

Square is very clear on which types of payments fall under which of its four interchange fee groups. Source: Square

Winner: Stax

We prefer Stax’s approach to the rate per transaction. This rate is the same no matter the transaction’s size, and it’s always smaller than the rate per transaction that Square charges.

Additional fees

Stax

Beyond its monthly premiums, the only fees Stax charges are chargeback fees. These fees result from customers disputing credit card transactions, and they’ll cost you $25 per transaction no matter how the dispute is resolved. Additionally, Stax doesn’t charge early termination fees, and other fees, such as Payment Card Industry (PCI) compliance and gateway fees, are included in your monthly premium.

Square

We like that Square charges no fees whatsoever — not even chargeback fees, which are common (and often pricey) in credit card processing. There are no fees for PCI compliance, early termination, gateway integrations or setup, either. Name a fee you might encounter among credit card processors other than interchange fees and Square will never charge it.

Winner: Square

Since chargeback fees never happen when you’re a Square customer, Square beats Stax when it comes to additional fees.

Third-party integrations

Stax

We were impressed with Stax’s integrations with many of the best accounting software platforms, including QuickBooks, Xero, Zoho Books and Wave. We also like that Stax integrates with some of the best email marketing software platforms, such as HubSpot and Mailchimp.

QuickBooks is the accounting software platform we recommend most strongly for small businesses. Read our QuickBooks review to learn more.

Additionally, Stax integrates with prominent payment gateways, such as WooCommerce and Magento, as well as most of the best POS systems. However, its integrations with Toast and Square POS are lacking since these platforms won’t connect with other POS platforms — which, to them, includes Stax.

Square

With Square, you get access to a custom API for integrating your system with in-person, remote and mobile payment options. We like the flexibility that these integrations offer your customers for making payments — and you for accepting payments. Beyond this, Square integrates with many types of business applications to streamline your sales and accounting data.

However, we were disappointed that Square lacks email marketing integrations. Since you can use Square to manage your online store, we expected email marketing integrations — they’re a great way to drive traffic to your store. In general, we found the brands with which Square integrates relatively unimpressive — many aren’t top names in their fields.

Winner: Stax

Stax’s integrations are more diverse and robust. We recommend Stax over Square for combining all your platforms seamlessly into one smoothly flowing workflow.

Payment methods

Stax

You can use Stax to process payments made in-person, via invoice, over the phone or using mobile or contactless technology. Stax can also process keyed-in payments and e-commerce payments. We like that, through this breadth of payment methods, you can serve nearly any customer.

Square

When customers hand you a credit card in person or read you their information via phone, you can process the transaction via Square. You can also process payments via invoice, digital wallet and ACH payment. We were happy to see ACH payments on Square’s list as this is a direct transfer of money between bank accounts. That’s about as transparent and direct as payment gets and we like that Square facilitates it.

Winner: Square

Square edges out Stax on payment methods because, unlike Stax, it facilitates ACH payments. That said, in virtually every other payment category, the two vendors are even.

With Square, your smartphone becomes your contactless payment device. Source: Square

E-commerce and reporting

Stax

Through Stax, you can generate reports that you can use to reconcile all your business bank accounts. We like that Stax includes this accounting feature. It gives you one more fundamental accounting need you can handle from within the platform rather than jumping to your accounting software. There are also transaction reports you can set to cover any period, and every account comes with dashboards and analytics.

Square

With Square, all your data and analytics arrive in real time so that you always have the most up-to-date information. You can look at your data without awaiting your team’s end-of-day inventory reports. You’ll also know which items to restock based on your real-time sales data. Additionally, when customers pay through your payment links, Square tracks your transaction, order and customer data automatically.

Winner: Stax

Stax barely edges out Square on reporting in our eyes. While we do like Square’s reporting, we find Stax’s time-filterable reports and clear dashboards especially useful.

Customer support

Stax

All Stax customers can access email, phone and live chat support 24/7. We like that all Stax customer support agents are employed in-house too, which always makes for better customer service. We also like that Stax pairs you with a dedicated account manager if your annual transaction volume exceeds $500,000.

Square

You can message Square for support from 6 a.m. to 6 p.m. PT on weekdays. Additional support is available via email or phone, though not 24/7 unless you opt into a monthly subscription. Your support options are much more limited if you go with the more affordable pay-as-you-go plan and this disappointed us.

Winner: Stax

Stax is the obvious winner between these two credit card processing brands when it comes to customer service. There are far fewer barriers to accessing Stax support relative to Square support.

Stax vs. Square Recap

Choose Stax if:

- You want flat-rate pricing that doesn’t balloon as your transaction volume does.

- You need 24/7 access to customer service and technical support.

- You’re looking for advanced credit card processing data, reports and analytics.

Choose Square if:

- You want a pay-as-you-go plan that keeps your credit card processing costs low when your transaction volume is low.

- You need advanced features for your restaurant, retail or appointment-based business alongside credit card processing services.

- You’re looking for a customizable online store that’s fully integrated with your credit card processing services.

FAQs

How do Stax customers reach the support team?

Stax recommends calling (407) 982-1782 to begin your customer support journey. In-house agents are available 24/7.

How do you close your Stax account?

You must submit a support form online to close your Stax account. Stax won’t charge you a cancellation fee.

How long does Square take to deposit money into your account?

After processing a transaction, Square deposits the money in your account in one to two days.

Can Square enable instant transfers?

Square can enable instant transfer if your business bank account is with any major United States bank. This includes Bank of America, JP Morgan Chase, Huntington National, Citizens Bank, PNC Bank, SunTrust, Regions and TD Bank.