Employee retirement benefits providers offer many common features. Most packages include certain core services, such as plan administration, recordkeeping and preparation of IRS filings. Some vendors also handle plan design (investment selection) and employee enrollment, serve as a plan fiduciary and sometimes even manage company payroll.

Here are the employee retirement plan functions we recommend paying close attention to:

Onboarding Support

Quality retirement benefits providers offer comprehensive employee education programs that include live enrollment meetings, interactive webinars and on-demand video libraries covering contribution strategies, investment basics and tax implications. The best onboarding programs use real-world scenarios to demonstrate concepts like compound interest and employer matching, making complex financial topics accessible to team members with varying levels of financial literacy.

Effective onboarding also includes follow-up communications and refresher sessions, since financial education is most effective when reinforced over time. Look for vendors that offer multilingual resources and personalized coaching sessions for employees who need additional support during the enrollment process.

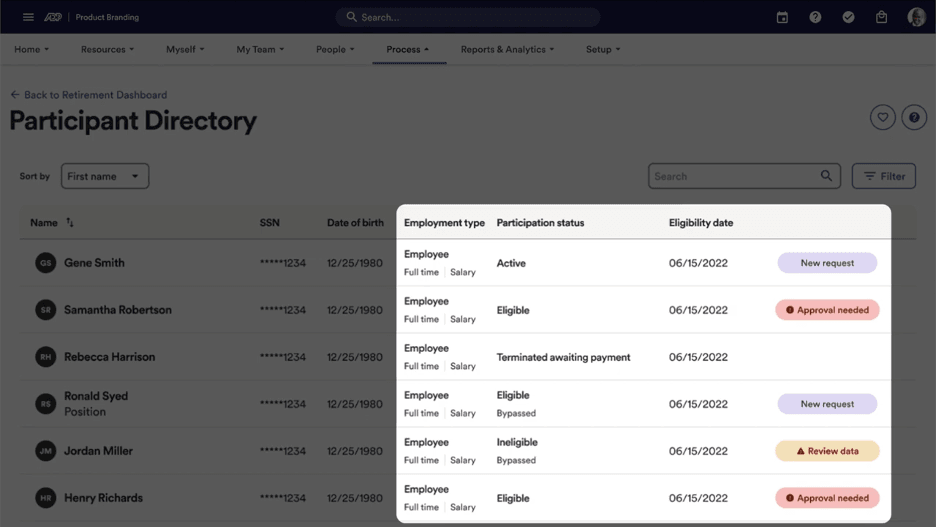

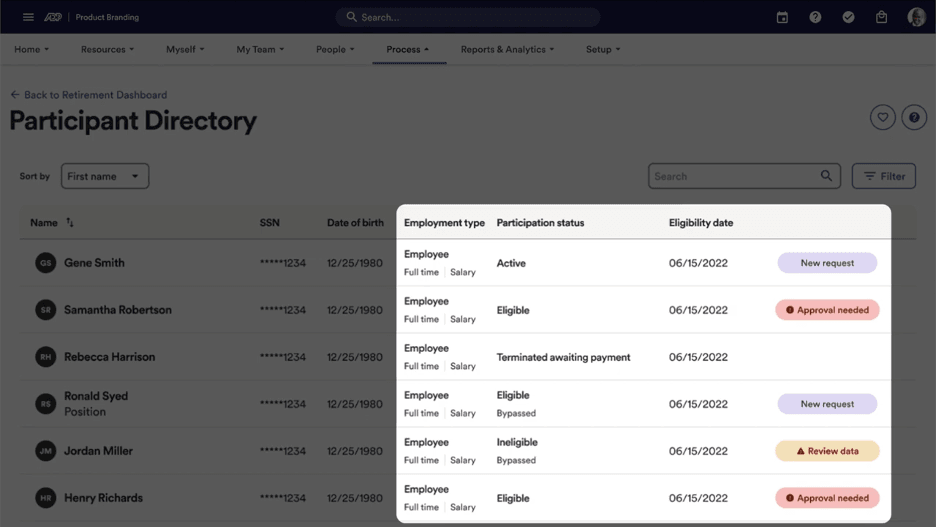

Most retirement plan providers make it easy for administrators to see who’s enrolled and who’s waiting for any approvals. Source: ADP

Easy Online Administration

Modern retirement plan administration should be completely digital, allowing plan sponsors to manage every aspect of their plan through intuitive web-based dashboards with real-time visibility into participation rates, compliance testing results and plan metrics. The best platforms enable automated workflows for common tasks like processing new hires and salary changes, with built-in validation rules to catch errors before they become compliance issues.

Advanced features include customizable reporting with scheduled delivery, integrated document management and automation that guides administrators through complex processes like annual testing. High-quality solutions offer single sign-on integration with your existing HR systems and role-based access controls to ensure security while maintaining ease of use.

Recordkeeping and Compliance

Comprehensive compliance management for retirement benefits includes proactive monitoring and automated safeguards that prevent issues before they occur. This involves maintaining detailed audit trails for all transactions and automating required participant notices and disclosures. Leading providers handle complex requirements, including annual discrimination testing, top-heavy testing and coverage testing, with automated correction procedures when issues arise. They manage Form 5500 preparation and filing, coordinate required plan audits for larger plans and retain comprehensive documentation to support regulatory examinations.

The best vendors also offer compliance calendars with automated reminders, stay current with changing regulations and provide consultation on plan design changes needed to maintain compliance.

Investment Selection

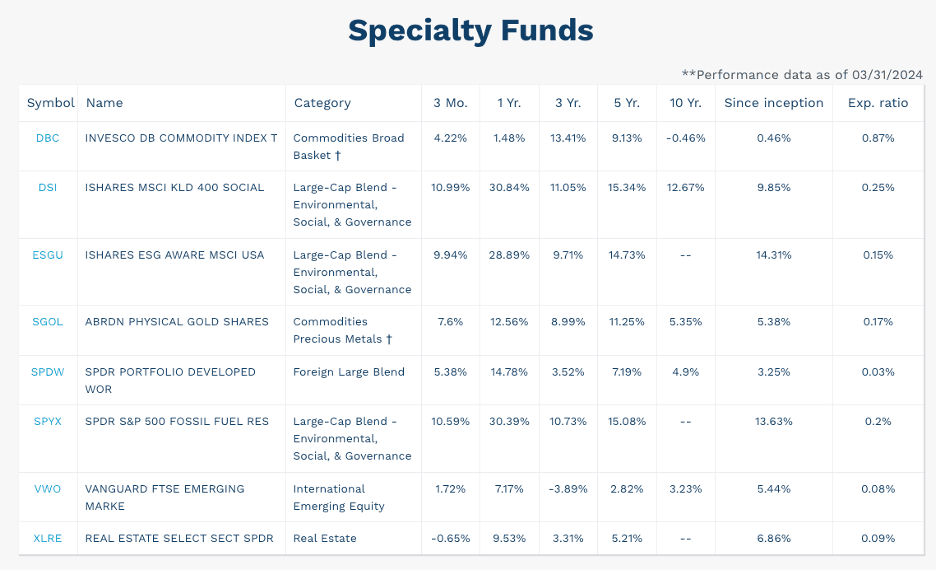

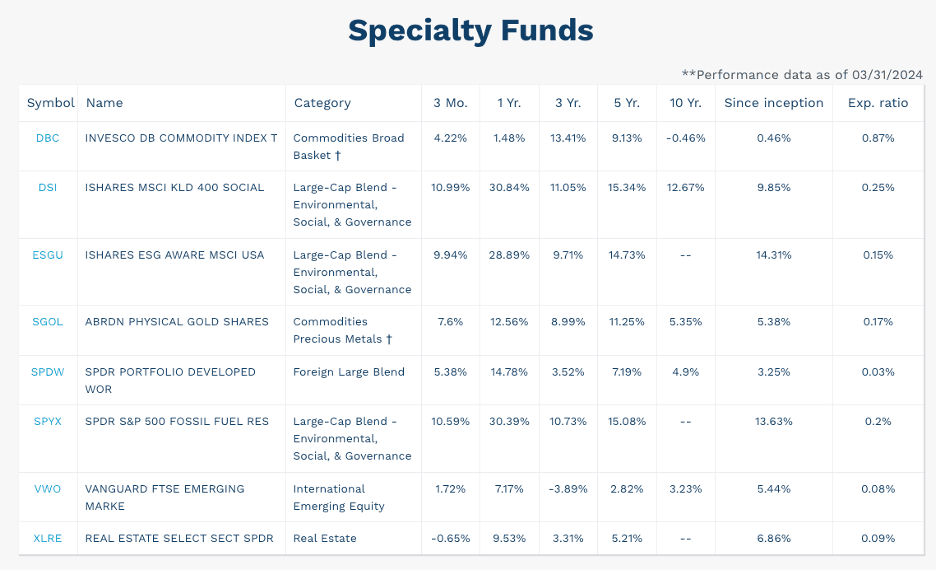

Professional investment oversight involves thorough due diligence to evaluate fund performance, management quality and expense ratios across multiple market cycles. Quality retirement benefits providers maintain diversified investment lineups covering all major asset classes while avoiding overlap and ensuring appropriate risk profiles for different participant demographics. They should offer both actively managed and passive index options, with a clear preference for low-cost investments that minimize participant fees.

Investment committees should meet regularly to review performance, monitor style drift and replace underperforming funds according to documented investment policies. Plans often include target-date funds and risk-based model portfolios as default options.

Consider the types of funds you and your employees would like available for investing, such as these from ShareBuilder 401k, before choosing a retirement plan provider. Source: ShareBuilder401k

Mobile Enrollment

Mobile accessibility has become essential as employees increasingly expect to manage their financial lives through smartphones and tablets. Quality mobile retirement plan platforms should offer full functionality, including tools for initial enrollment, contribution rate adjustments, investment allocation changes, and loan or distribution requests — not just basic account viewing.

The best mobile experiences use responsive designs with intuitive navigation that make complex financial concepts accessible to users with varying technical skills. Advanced mobile features include biometric authentication for security, push notifications for important plan updates and mobile-optimized educational content, including interactive calculators and short video tutorials.

Employee Resources

Comprehensive participant support should include multiple communication channels, such as dedicated toll-free numbers to connect with knowledgeable plan representatives, secure messaging systems and live chat functionality during business hours. Quality providers offer financial wellness assessments that help employees understand their retirement readiness, along with actionable recommendations for improvement.

Advanced support includes one-on-one financial coaching sessions and extensive online resource libraries with articles, calculators and tools covering topics like debt management and emergency savings. Some leading vendors also partner with financial wellness companies to offer guidance beyond retirement, including student loan assistance and budgeting tools that help employees improve their overall financial stability.

Artificial Intelligence Tools

AI-backed retirement planning tools use advanced algorithms to analyze individual participant data, including age, salary, current savings and risk tolerance, to provide personalized recommendations for contribution rates and investment allocations. These systems continuously monitor market conditions and participant circumstances to suggest portfolio rebalancing and contribution adjustments that keep employees on track toward their retirement goals.

Modern AI-powered advisors integrate with broader financial wellness platforms to provide holistic guidance considering employees’ complete financial picture, including debt obligations and emergency savings. The best vendors also use predictive analytics to identify participants at risk of inadequate retirement savings and provide proactive outreach with specific, actionable recommendations. AI-driven chatbots offer instant answers to complex questions about plan features and investment options.