Every year, as tax season rolls around, business owners across the country wonder what deductions they can claim on their tax returns. Certain companies and individuals have come up with some surprising, creative deductions that have been accepted by the IRS or United States Tax Court. These tax deductions may or may not apply to your business but, as tax deadlines approach, it’s worth seeing if the absurdity of some business laws can work in your favor.

Crazy but legal tax deductions

If a tax deduction sounds too good to be true, it probably is — unless it isn’t. Some deductions that seem luxurious or like they may have to do with personal enjoyment might sound crazy to claim as tax deductions, but doing so may be legal and to your financial benefit. Indeed, in some cases, the IRS has determined that these expenses are acceptable if they serve legitimate business, medical or other deductible purposes.

Consider the examples below but be sure to consult your tax professional or the tax code before actually claiming any of these as deductions on your return.

Limos

It turns out that if you need to take limousines for work purposes, such transportation can be written off as a deduction. Especially for self-employed professionals, such as models and entertainers, writing off everything pertaining to work might mean writing off your limo rides or hair and makeup purchases.

You may not receive a full deduction for your limo expenses, however, if you purchase or lease a limo. The IRS limits depreciation or lease deductions on what it considers to be luxury cars.

Gym memberships

Your gym membership may qualify as a deductible medical expense. There are some criteria, however, that you’ll have to meet. For example, a doctor has to diagnose you with a specific medical condition and, technically, you should be using the facility as a way to treat this condition. Furthermore, you can’t have belonged to the gym before your diagnosis. So, as with many of these deductions, while it is possible to itemize your gym membership, you would need to be in a pretty specific scenario to write this off legally.

Beer

In the early 1980s, a tax court ruled that businesses can write off free beer as a tax deduction in some instances. In this case, the business owner provided free beer to customers and wrote off the expense. While it may not be a good idea to try something similar, it does offer an interesting opportunity to consider when stocking in-office beer fridges; you may be able to deduct it on your tax return.

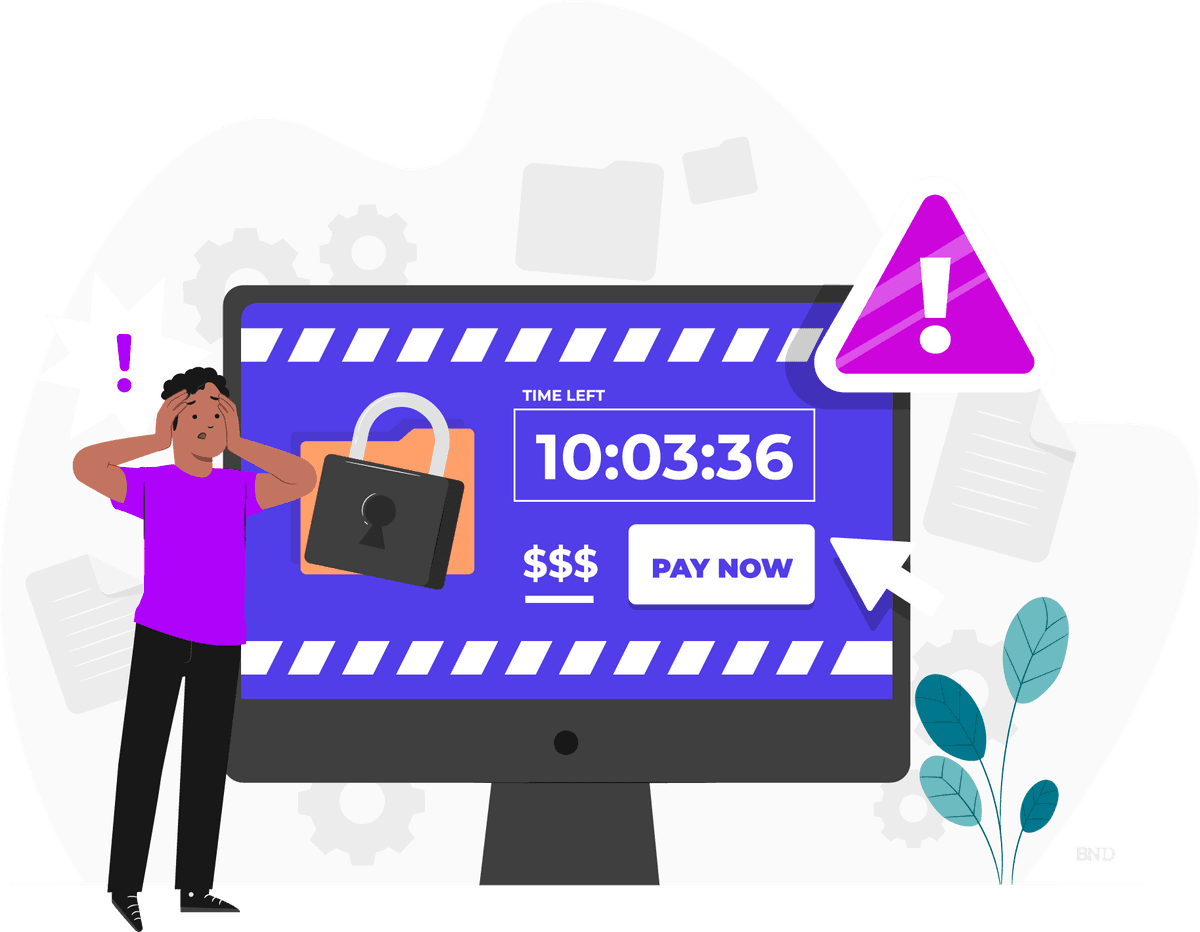

Ransoms

In recent years, businesses have been plagued by ransomware attacks from cybercriminals demanding large sums to decrypt their essential data, usually with such requests requiring the companies pay in bitcoin. While it isn’t recommended that business owners pay these ransoms, sometimes organizations have no choice but to pay or risk losing much more.

If you do pay a ransom, the amount can be itemized on your taxes as a business expense similar to other acts of theft and extortion. You’ll need to provide proof of the incident and the amount paid to the IRS. Your evidence can be in the form of a police report. [Find out how to protect your business from ransomware.]

Bitcoin

While bitcoin sometimes has a negative reputation due to being the favored currency of cyberattackers, it can have a positive impact both on the world and on your taxes. As with any profit gained from investments, you must report money made from investing in bitcoin and pay taxes on it. However, instead of pocketing the profit, giving your bitcoins away to charity allows you to take a deduction on your taxes.

For example, giving to an organization like Fidelity Charitable, which accepts bitcoin, will give you a tax deduction equal to the market value of the bitcoin while avoiding having to pay capital gains tax, according to Nabil Ashour, director of strategy at Fidelity Investments.

Pets

Pets are not dependents and cannot be claimed as such on taxes; however, if you use pets for your business, certain expenses are deductible, according to Joshua Zimmelman, managing partner at Westwood Tax & Consulting. If you breed pets, use them in your advertising materials or have a guard dog, you can deduct expenses like food, grooming and training. Keep in mind these costs must be related to the hours your pet “works,” and they need to be documented.

Also, “this only applies to certain animals in certain situations,” Zimmelman said. “For example, you can say that a Rottweiler is a watchdog, but don’t try that with a hamster, or you will probably raise a red flag at the IRS.”

Ideally, you should determine the deductibility of an expense before you spend the money. Knowing any limitations or requirements to take a deduction may make a difference during the purchase process and when doing your taxes.

Hair dye

In the same way pets can be used for advertising and branding, certain aspects of a person can be considered a business expense if they’re used this way. Bobbi Baehne, president of Think Big Go Local, dyed her hair purple for a convention and has kept it ever since. She is the face of the company and her purple hair is now considered part of her business’ branding.

“My accountant quickly let me know that the purple hair has become part of our brand and, in turn, is advertising for our company,” Baehne said. “So I get to write off the $200-plus I pay a month to keep it fun and fresh.”

Fitness and health initiatives

Fitness and health initiatives have lots of potential for deductions. While you can’t deduct gym memberships for employees, if you own and maintain an office gym, then you can deduct the expenses associated with it. Programs to help employees quit smoking are also deductible.

You can also generally deduct expenses that help boost workspace productivity while protecting employee health, such as ergonomic consultations and special office furniture. [Learn why you should offer an employee health and wellness plan.]

Body oil

Professional bodybuilders can itemize the ordinary and necessary costs of their profession, including body oil. The slick stuff that makes their muscles shine is deductible but, in one case, a tax court ruled that expenses like food and supplements used to get the bodybuilder physique don’t qualify.

Cosmetic surgery

A tax court case in 1988 opened the door for adult entertainers to deduct breast augmentation surgery. A stripper claimed a $2,088 deduction for her surgery, which was initially denied by the IRS but accepted by the tax court when she appealed. The court ruled that the augmentation was a legitimate business expense because it could result in bigger tips and more profit for the stripper.

Landscaping and home improvement

For self-employed and at-home workers, expenses incurred when sprucing up the old homestead can be itemized as long as you can prove the improvements are tied to your business. For example, if you often meet with clients at your residence, making your house more appealing can break down to deductible expenses, such as the tools you use for landscaping and home improvement.

Renovations on your home to make space for an office can also be deductible. Be aware that the IRS has strict guidelines on what constitutes a home office, though. Primarily, your home office must be a principal place for your business and used exclusively for work. The two exceptions to the exclusivity rule are use as a child care center or for storage of inventory or product samples.

International travel

Travel expenses around the country are commonly deductible and this also extends to most of North America. Up to certain limits, you can itemize expenses for travel to the Bahamas, Bermuda, Costa Rica and other Central American spots. Of course, the purpose of such travel has to be related to your company, such as a meeting with clients.

Furthermore, to take the deduction for travel outside North and Central America, you need to provide proof that it was reasonable to conduct your business at that location. For example, you’d need to explain to the IRS why your convention in China couldn’t be held anywhere else for the expenses to be tax-deductible. However, you don’t have to justify why your meeting or convention was held in qualifying Central American locations.

The costs of attending a convention or seminar on a cruise ship are also deductible, to a point. You must provide comprehensive proof that the cruise was mostly devoted to business activities and that you participated in them yourself. Your deduction is limited to twice the highest federal per diem rate allowable at the time of your travel. It is also limited to a maximum of $2,000 per year.

Whaling ships

Speaking of ships, whaling captains can itemize expenses related to their vessels, such as repairs. Notably, whaling is highly illegal for all but certain cultures. In the U.S., you must be a recognized captain of the Alaska Eskimo Whaling Commission to qualify for the deduction. If you’re practicing unsanctioned whaling, you may have bigger problems than missing out on a tax deduction.

If you need to make an expenditure for your business or another tax-related purpose, such as medical care, you may be able to deduct the expense no matter how crazy it seems.