MENU

Start

- Best Small Business Loans for 2024

- Businessloans.com Review

- Biz2Credit Review

- SBG Funding Review

- Rapid Finance Review

Our Recommendations

- 26 Great Business Ideas for Entrepreneurs

- Startup Costs: How Much Cash Will You Need?

- How to Get a Bank Loan for Your Small Business

- Articles of Incorporation: What New Business Owners Should Know

- How to Choose the Best Legal Structure for Your Business

Our Guides

- Business Ideas

- Business Plans

- Startup Basics

- Startup Funding

- Franchising

- Success Stories

- Entrepreneurs

Small Business Resources

Grow

- The Best Credit Card Processors of 2024

- Clover Credit Card Processing Review

- Merchant One Review

- Stax Review

Our Recommendations

- How to Conduct a Market Analysis for Your Business

- Local Marketing Strategies for Success

- Tips for Hiring a Marketing Company

- Benefits of CRM Systems

- 10 Employee Recruitment Strategies for Success

Our Guides

- Sales & Marketing

- Finances

- Your Team

- Technology

- Social Media

- Security

Small Business Resources

Lead

- Best Business Phone Systems of 2024

- The Best PEOs of 2024

- RingCentral Review

- Nextiva Review

- Ooma Review

Our Recommendations

- Guide to Developing a Training Program for New Employees

- How Does 401(k) Matching Work for Employers?

- Why You Need to Create a Fantastic Workplace Culture

- 16 Cool Job Perks That Keep Employees Happy

- 7 Project Management Styles

Our Guides

- Leadership

- Women in Business

- Managing

- Strategy

- Personal Growth

Small Business Resources

Find

- Best Accounting Software and Invoice Generators of 2024

- Best Payroll Services for 2024

- Best POS Systems for 2024

- Best CRM Software of 2024

- Best Call Centers and Answering Services for Busineses for 2024

Our Recommendations

Online only. Expires 4/27/2024

8 Tax Season Preparation Steps

Table of Contents

Business tax filing deadlines can catch busy entrepreneurs and small business owners by surprise. Advance planning is crucial for staying ready and prepared as tax season approaches. We’ll explore tax preparation best practices that will keep you organized all year long so you can file accurate tax returns without any financial surprises for your company.

When is tax season?

Tax season is the post-tax-year time individuals and businesses use to prepare their tax returns without incurring late-filing penalties. However, for businesses, tax season is broader and includes the following obligations:

- Traditional tax season. Tax season is traditionally the time between the end of January — when most people receive tax information for the prior year — and April 15, when individual tax returns are generally due. However, tax season for businesses depends on the organization type, business tax year, and whether the business files for a filing extension.

- Quarterly taxes. All but the smallest businesses must file or pay some form of tax more often than once per year. If you’re required to pay quarterly estimated taxes, you have four due dates throughout the year. Quarterly estimated tax payments are due on April 15, June 15, September 15 and January 15 or on the next business day following a weekend day.

- Payroll taxes. If you have employees, you must also file federal, state and local payroll taxes throughout the year.

Although the time when most annual income tax returns are prepared and filed is referred to as tax season, business owners should plan and organize to meet their tax obligations all year long.

If you need help managing payroll taxes, consider using one of the best payroll services that can handle tax compliance, payroll processing and more.

Tax season preparation tips

Whether you’re preparing to file last year’s business tax return or want to plan strategically for the current year, here are tax preparation best practices.

1. Organize your tax paperwork.

The best way to ensure your tax paperwork is organized is to keep excellent records all year. That way, after the end of the year, you’ll just have to gather the applicable tax documents that arrive in the mail or become available online.

Marc Scott, CPA at California-based M. Scott and Company, said planning heats up in January when companies begin sending out and receiving essential tax documents.

“There’s a lot of tax reporting that goes on in January, so you’re going to be receiving a lot of documentation,” Scott said. “For most businesses, it makes sense to have the books ready around a similar timeframe.”

If you have a small organization, getting a head start is crucial to avoid a last-minute rush and allow time in case your tax professional has additional questions and information requests.

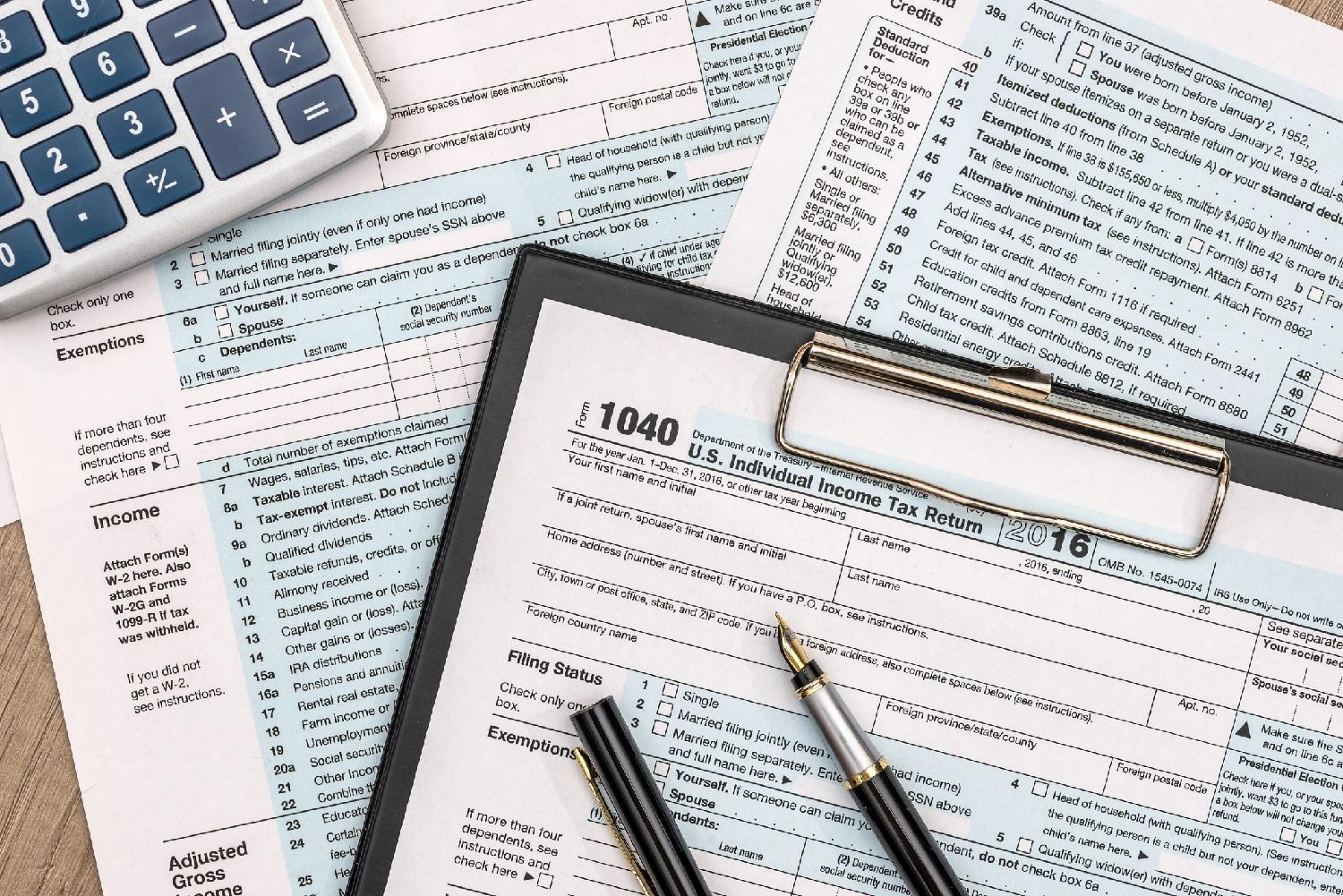

What should I bring my tax preparer?

If you hire a CPA or other tax professional to prepare your business tax returns, they’ll need some key documents:

- Proof of identity. As of 2016, tax preparers are required to ask for proof of your identity.

- Business tax ID. You also must provide your business tax ID, which may be your Social Security number or your Employer Identification Number.

- Financial records. The tax preparer also needs your business financial records for the year. This includes income from gross receipts from sales or services, sales records, returns, business bank account interest, and other income. It also includes the cost of goods sold (such as your inventory), beginning inventory total dollar amount, inventory ending dollar amount, items removed for personal reasons, and materials and supplies. You should also have business expense documentation. Deductible business expenses include items like business rent, home office expenses and contract labor.

Excellent recordkeeping is crucial in the event of a tax audit, during which the IRS examines your tax return information to ensure the reported data is correct.

2. Understand qualified deductions and credits.

Tax deductions and credits are a critical part of the filing process. Tax deductions reduce your taxable income. Tax credits, on the other hand, directly reduce your business’s tax liability.

The number of business tax credits and deductions is extensive, including credits you may not know about that apply to particular industries, such as for biodiesel use or for employers who offer employee benefits like childcare.

If you think you may qualify for a deduction or credit, talk to your tax preparer. If you use tax preparation software, carefully answer all questions about your business operations.

Tax software and other tax solutions generally use step-by-step interviews to gather all information necessary to prepare your return. Following the step-by-step process is the best way to ensure your return is complete and correct.

3. Learn about the latest tax laws.

Regardless of how you prepare your taxes or pay to have them prepared, you must stay updated on recent and future small business tax law changes and how they may affect your business so you can plan and adapt accordingly.

The most significant recent changes for small business taxes include the end of special programs and tax relief put in place during the COVID-19 pandemic. For example, net operating losses carried forward generally cannot offset more than 80 percent of your taxable income. That limitation did not apply to net operating losses generated in 2018, 2019 or 2020. However, any net operating losses generated after 2020 are subject to the limitation of 80 percent of taxable income again.

On the positive side, the SECURE Act increases the credit for some employer contributions to employee pensions, and pass-through entities like partnerships and S corporations may still qualify for a 20 percent deduction based on their income.

4. Itemize business expenses.

According to Scott, detailing, itemizing and categorizing your business expenses ahead of time will save significant time and hassle come tax day.

Work closely with the bookkeeping and accounting teams (if your business is big enough) or with outside help to put yourself in a position to claim the maximum benefit from your expenses. In addition, the more organized your information, the more money you should save on your tax preparation bill.

5. Calculate projected payroll taxes.

Along with expenses and deductions, your payroll taxes should be up to date and calculated throughout the year. If you have employees, you generally must file at least quarterly, if not more often. You must also make payroll tax deposits as required or face steep penalties.

For very small businesses, payroll tax filing and payment obligations can be more significant than income taxes. Ensure you understand payroll taxes and include them in your business budget and planning.

6. Keep up with your home state’s tax issues.

Most tax professionals prepare your state return in addition to the federal return. However, you should pay as much attention to changes in state requirements as to IRS rules if you don’t want to be taken by surprise.

For example, some states take out loans from the federal government to meet unemployment benefits liabilities. Jamal Ayyad, head of product management at SurePayroll, noted that if your state has taken — but not repaid — those loans, there will be a reduction in the credit against the Federal Unemployment Tax Act tax rate. This means employers in those states must pay more.

A number of states may be affected, including Arizona, Arkansas, California, Connecticut, Delaware, Indiana, Kentucky, New York, North Carolina, Ohio, Rhode Island and South Carolina, as well as the U.S. Virgin Islands.

The best states for small business taxes include Wyoming, South Dakota and Alaska. Some of the worst include New Jersey, New York and California.

7. Consider a tax filing extension.

Businesses can request filing extensions from the IRS, just like individuals. An extension gives you six additional months (generally until October 15) to file your taxes.

Use Form 7004 to request an automatic extension. According to Scott, it may be to a business’s advantage to take the additional time. Often you may need clarity on a tax issue to ensure you’re in compliance with regulations, or some of your clients and customers were slow to deliver the right paperwork to your team.

However, the extension only grants you a grace period to file your final return — you still must pay the taxes you believe you owe or face late payment penalties. Even if you underpay, you avoid late filing penalties by filing for an extension.

8. Think about emergency and succession planning.

What would happen to your business if you had an unexpected health crisis or accident? Business owners should analyze and formulate an action plan that ensures the business continues. Succession planning may also yield tax benefits, so check with your attorney and accountant.

Ayyad said organizing these tax records now makes filing business taxes easier and faster later. If you do succession planning early, you’ll reduce stress for you and your team later.

“When small business owners get their information together well ahead of time, they greatly improve the odds of filing a complete and accurate return,” Ayyad said. “Being compliant is the law, but instead of merely checking taxes off of a list of things to do at the end of the year, a savvy small business owner knows that preparation and planning ahead are key components of success.”

When can I file my taxes?

You can begin working on your returns as soon as you want after the end of the tax year, whether you are partnering with a tax preparer or using tax software to prepare it yourself.

The IRS doesn’t review and process your return until the official start date. This date for calendar year returns is usually near the end of January. However, you may receive tax forms, such as Form 1099s, through the first week of February. Ensure you’ve received all your information forms before filing to avoid having to file an amended return later.

Online tax software is an easy and convenient way to stay on top of your tax obligations.

Common tax season mistakes

Don’t let these common mistakes sabotage your tax season:

- Waiting until the last minute. It takes time to find and organize your records, update your tax knowledge, and do everything else necessary to achieve optimum tax results for your business. Even working on your taxes a little at a time can make tax season go far more smoothly and efficiently.

- Maintaining inadequate or disorganized records. Getting your business organized may seem challenging, but it’s much easier than dealing with chaos at tax time.

- Blending personal and business finances. Having separate personal and business bank accounts and records is much more professional and greatly simplifies tracking business income and expenses at tax time.

- Not asking for help in time. Tax professionals get busy during tax season. Make your appointment early. Be sure to schedule other help you may need, such as legal or bookkeeping help.

Get ready for tax season now

No matter what time of year it is, you can always take steps to prepare for the current tax season and for seasons to come. If tax prep seems overwhelming, do one thing now to get ready, such as organizing one file or opening a business checking account. Every step you take to improve organization and planning will pay you dividends in less time, frustration and expense at tax time.

Derek Walter contributed to this article. Source interviews were conducted for a previous version of this article.