MENU

Start

- Best Small Business Loans for 2024

- Businessloans.com Review

- Biz2Credit Review

- SBG Funding Review

- Rapid Finance Review

Our Recommendations

- 26 Great Business Ideas for Entrepreneurs

- Startup Costs: How Much Cash Will You Need?

- How to Get a Bank Loan for Your Small Business

- Articles of Incorporation: What New Business Owners Should Know

- How to Choose the Best Legal Structure for Your Business

Our Guides

- Business Ideas

- Business Plans

- Startup Basics

- Startup Funding

- Franchising

- Success Stories

- Entrepreneurs

Small Business Resources

Grow

- The Best Credit Card Processors of 2024

- Clover Credit Card Processing Review

- Merchant One Review

- Stax Review

Our Recommendations

- How to Conduct a Market Analysis for Your Business

- Local Marketing Strategies for Success

- Tips for Hiring a Marketing Company

- Benefits of CRM Systems

- 10 Employee Recruitment Strategies for Success

Our Guides

- Sales & Marketing

- Finances

- Your Team

- Technology

- Social Media

- Security

Small Business Resources

Lead

- Best Business Phone Systems of 2024

- The Best PEOs of 2024

- RingCentral Review

- Nextiva Review

- Ooma Review

Our Recommendations

- Guide to Developing a Training Program for New Employees

- How Does 401(k) Matching Work for Employers?

- Why You Need to Create a Fantastic Workplace Culture

- 16 Cool Job Perks That Keep Employees Happy

- 7 Project Management Styles

Our Guides

- Leadership

- Women in Business

- Managing

- Strategy

- Personal Growth

Small Business Resources

Find

- Best Accounting Software and Invoice Generators of 2024

- Best Payroll Services for 2024

- Best POS Systems for 2024

- Best CRM Software of 2024

- Best Call Centers and Answering Services for Busineses for 2024

Our Recommendations

Human Interest Employee Retirement Review

Table of Contents

Human Interest keeps costs down for employers and employees, offering low-cost plans with a lot of features and functionality. When you work with Human Interest, you get affordable full-service retirement plans, earning it our best pick for affordability.

- Monthly rates start at just $120 per month, plus $4 per employee per month.

- Human Interest entirely covers certain required fees, which most other vendors would charge.

- Human Interest includes free built-in investment advice and automatic portfolio rebalancing for employees.

- Despite its low plan prices and value for your dollar, Human Interest charges a high one-time setup fee.

- Only the highest-price Human Interest plan includes dedicated account management.

- Solo 401(k) plans are not available.

- Human Interest plans start at just $120 per month, plus $4 per employee per month, with certain typical fees eliminated.

- There are three levels of retirement plan services to choose from.

- Plans include full recordkeeping and administration, as well as payroll integration.

- This review is for small business owners and HR professionals who are considering Human Interest as their employee retirement plan provider.

Human Interest is an online employee retirement benefits provider that specializes in providing cost-effective, easy-to-use 401(k) plans to small businesses. Using Human Interest, business owners can get benefits plans that start at just $120 per month, plus $4 per employee per month, including full recordkeeping, administration tools and seamless payroll integration. For this reason, Human Interest is our best pick for affordable employee retirement provider.

Human Interest Employee Retirement Editor's Rating:

9.6 / 10

- Transparent pricing

- 10/10

- Low employee investment fees

- 9.5/10

- Variety of plans

- 9/10

- Customization

- 9.5/10

- Integration with HR and payroll tools

- 10/10

Why Human Interest Is Best for Affordability

Human Interest is the best employee retirement provider for affordability because it’s both cost-effective and more transparent about pricing than many other providers in the space. The $4-per-employee charge is relatively low, especially for plans that offer easy payroll integration as well as full plan administration and recordkeeping.

Additionally, Human Interest entirely covers certain required fees that all other vendors charge. For example, in late 2020, Human Interest began covering the fee for employees taking distributions early. With Human Interest, even compared to other low-cost vendors such as ShareBuilder 401k, you get more value per dollar spent.

Human Interest Plans

| Feature | Essentials | Complete | Concierge |

|---|---|---|---|

| Payroll integration | Yes | Yes | Yes |

| Automated administration and recordkeeping | Yes | Yes | Yes |

| Plan administration | No | Yes | Yes |

| Human Interest acts as 3(16) fiduciary | No | Yes | Yes |

| Tax support | No | Yes | Yes |

| Dedicated account management | No | No | Yes |

Essentials

Essentials is Human Interest’s basic plan. It includes automated administration and recordkeeping, as well as integration with more than 300 payroll providers. Employers can customize plans to include safe harbor plans and Roth and traditional 401(k) plans and 403(b) plans. The Essentials plan also enables employers to design vesting schedules and includes automatic enrollment, employer matching contributions and more.

Complete

In addition to the integrations and automations available through the Essentials plan, Complete plan customers get more advanced services from Human Interest’s team. With this option, Human Interest acts as plan administrator and 3(16) fiduciary. The Complete plan also includes tax support, in that Human Interest signs and files IRS documents. Human Interest will also procure your ERISA bond at this tier.

Concierge

Concierge is Human Interest’s most comprehensive employee retirement plan. Employers get access to all of the features included in the Complete plan, plus dedicated account management, which further streamlines administration and makes it easier to provide employee retirement benefits. However, other brands such as ShareBuilder 401k offer dedicated account management at all pricing tiers.

Concierge customers also get a single point of contact for plan administration and compliance. These customers also don’t have meeting caps, additional fees or minimum requirements. Plan design consultation and document review will occur on an ongoing basis as well.

Additional Features

- Administrative compliance: Business owners can choose a plan that puts IRS and DOL reporting and compliance in the hands of a Human Interest account manager.

- Payroll integration: Human Interest’s platform syncs with more than 300 of the most popular payroll companies, making it easier to track and process employee contributions.

- Reporting: Employers can access Human Interest’s administrator dashboard to view reports, evaluate employee adoption and complete other functions. We were impressed with how accessible Human Interest makes these reports. You can quickly load them in your employer dashboard, whereas most brands require you to call them to obtain these reports.

- IRS documents: Business owners can simplify tax preparation by choosing Human Interest’s Complete or Concierge plan. With either of these options, Human Interest reduces paperwork and minimizes the risk of missing deadlines by preparing, signing and filing IRS forms.

- Employee resources: Human Interest provides employees with built-in investment advice and automatic portfolio rebalancing. Employees can also access support for rollovers, loans and hardship withdrawals via phone and email. There is also an online learning center for both employees and employers. All employees on all Human Interest pricing plans can access these resources.

- Employee investing flexibility: Through Human Interest, employees can get recommendations for how much money per paycheck to invest. The platform also recommends certain portfolios to employees, who can then change their asset distribution via a user-friendly slider. Employees can answer certain questions to get better recommendations and customize their portfolios however they please. Only Paychex is similarly streamlined on this front.

- Automated portfolio management: Employee funds can be invested in a diversified and low-cost portfolio and rebalanced every quarter. This makes retirement investing easier for employees who aren’t comfortable managing their own funds.

Employee retirement benefits closely integrate with top payroll software so that employers and employees can easily track pay and benefits together.

Account Types

Human Interest offers several types of retirement plans. Each plan has its own rules and regulations, as determined by the IRS.

- Traditional 401(k): Conventional 401(k) plans allow for pretax deductions, which employers can choose whether to match.

- Roth 401(k): Roth accounts allow for after-tax contributions and tax-free growth and distributions.

- Safe harbor 401(k): Safe harbor 401(k) plans include certain matching provisions that allow business owners to maximize their own contributions each year.

- 403(b): These plans are most commonly used by government agencies and nonprofits, but they may be useful for small churches and philanthropic organizations. Human Interest is one of very few employee retirement vendors we reviewed that offers this type of retirement plan.

Investment Options

Human Interest keeps investment options simple for employees, focusing on a short lineup of mostly stock and bond mutual funds. Through Human Interest, employees also get access to some funds with international exposure and a couple of funds focused on real estate. However, Human Interest’s primary goal is to offer a selection of cost-effective funds that are diversified and easy to choose from. The company offers the following types of investments:

- Stock mutual funds

- Bond mutual funds

- International mutual funds

- Real estate funds

- An FDIC-insured cash deposit account

While Human Interest doesn’t offer a ton of investment options, it focuses on minimizing employee expenses and risk and limiting them to choices that offer diversification. This makes it easy for employees to choose investment options that don’t involve too much risk to their nest egg. This balance of relatively few investment options and a focus on low costs is also true of ShareBuilder 401k, our top pick for low fees.

For another great low-cost employee retirement option, read our ShareBuilder 401k review.

Human Interest Cost

- Essentials: $120 per month base fee, plus $4 per eligible employee per month

- Complete: $150 per month base fee, plus $6 per eligible employee per month

- Concierge: $150 per month base fee, plus $8 per eligible employee per month

With all of Human Interest’s retirement plans, a one-time $499 setup fee may apply. In addition to the plan costs incurred by employers, enrolled employees pay 0.5% per year on their plan assets, plus 0.07% average fund fees.

Ease of Use

Signing up for Human Interest is pretty simple. Start by navigating to the Get Started button on the homepage and identifying the number of employees your business has. Then, select which payroll provider you use and indicate whether your business has an existing retirement plan and, if so, what kind.

Finally, provide contact information so a Human Interest representative can contact you. A Human Interest representative told us that, according to company data, the average time it takes to navigate this online setup process is three minutes. You can also call the company directly or submit your contact information online to schedule a call with a Human Interest representative.

Once you set up a retirement plan with Human Interest, administration and payroll are largely integrated. Although there are a number of helpful resources in the online support center, Concierge users can also direct questions to their dedicated account manager.

Plan participation is also easy for employees, as Human Interest emails instructions for creating an account, setting a contribution rate, choosing investments and opting out. The employee account user interface is clear, clean and crisp as well – significantly more so, in fact, than we found in our review of Paychex. (We do nevertheless highly recommend Paychex for all-in-one service.)

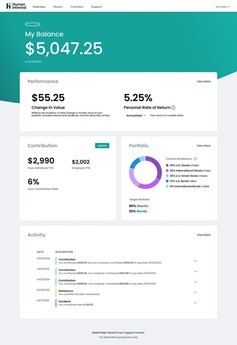

An employee dashboard makes managing retirement investments easy Source: Human Interest

Customer Service

If you’re considering Human Interest for your business’s employee retirement needs, it’s easy to contact the sales team by phone or online form. Human Interest employers and employees can contact support via telephone Monday through Friday from 9 a.m. to 8 p.m. ET. A Human Interest representative told us that 97% of incoming support calls reach an actual person within 30 seconds.

If you prefer another customer service method, you can fill out a contact form through the Human Interest Support Center. Plan administrators can contact customer support directly through their account representatives.

Additionally, during setup, Human Interest connects all customers, regardless of pricing tier, with an onboarding specialist. After setup, Concierge-tier customers can easily reach their dedicated account manager.

Drawbacks

One of the biggest drawbacks we identified when reviewing Human Interest is its one-time installation fee of $499. Although setup fees are common throughout the employee retirement benefits industry, Human Interest charges an especially high fee. The company sometimes waives this fee when running promotions, however, and may be open to negotiation.

Additionally, Human Interest provides dedicated account management only for customers on its highest pricing tier. Other brands such as USA 401k offer this service for all paying customers. That said, all Human Interest customers receive extensive automated administration and recordkeeping. As such, dedicated account management may be more of a nice to have than a need for Human Interest customers.

Human Interest also lacks solo 401(k) options, as the brand is clearly geared toward employers looking to near-fully automate plan administration. Other brands that do offer this plan include ShareBuilder 401k, which may be a better fit for sole proprietors.

Considering alternatives to Human Interest? Read our review of ADP or our USA 401k review.

Methodology

To choose our best pick for affordability, we examined employee retirement benefits providers that keep costs low and don’t charge excessive fees. When reviewing companies, we considered the overall costs of setup and maintenance fees and the plan price per employee per month.

Next, we considered the breadth of features and services these affordable plan providers offer. We chose Human Interest as our top pick for affordability because it offers a wide array of investment options and automated administration and recordkeeping. It does so while covering certain mandatory costs that other vendors always charge. This means you get more value for every dollar you spend with Human Interest.

Human Interest FAQs

Human Interest is a very sound company specializing in streamlined online offerings. The company, which was valued at $1 billion in its August 2021 round of fundraising, offers a core lineup of employer-sponsored retirement plans that are easy to set up and administer.

Human Interest is an excellent 401(k) provider. While the company isn’t the absolute cheapest option available, it’s extremely transparent and very reasonably priced. What’s more, the company handles all plan administration and recordkeeping, integrates easily with company payroll, and can even act as a plan fiduciary – all for a small, transparent fee. Plus, it pays for certain mandatory fees that your employees might incur rather than passing them along, increasing the brand’s affordability.

Human Interest is a startup that was founded by Paul Sawaya and Roger Lee. It also has outside investors, including SoftBank, NewView Capital, Glynn Capital, U.S. Venture Partners, Wing Venture Capital, Uncork Capital, Slow Capital and Susa Ventures.

Overall Value

We recommend Human Interest for …

- Companies seeking excellent value for their money with an employee retirement vendor.

- Small employers that want easy-to-manage safe harbor plans.

- Small churches and foundations that could qualify for 403(b) plans.

We don’t recommend Human Interest for …

- Companies that need dedicated account management included with a low pricing tier.

- Companies concerned about high setup fees.

- Solopreneurs in need of a self-employed 401(k).

Dock Treece also contributed to this article.