MENU

Start

- Best Small Business Loans for 2024

- Businessloans.com Review

- Biz2Credit Review

- SBG Funding Review

- Rapid Finance Review

Our Recommendations

- 26 Great Business Ideas for Entrepreneurs

- Startup Costs: How Much Cash Will You Need?

- How to Get a Bank Loan for Your Small Business

- Articles of Incorporation: What New Business Owners Should Know

- How to Choose the Best Legal Structure for Your Business

Our Guides

- Business Ideas

- Business Plans

- Startup Basics

- Startup Funding

- Franchising

- Success Stories

- Entrepreneurs

Small Business Resources

Grow

- The Best Credit Card Processors of 2024

- Clover Credit Card Processing Review

- Merchant One Review

- Stax Review

Our Recommendations

- How to Conduct a Market Analysis for Your Business

- Local Marketing Strategies for Success

- Tips for Hiring a Marketing Company

- Benefits of CRM Systems

- 10 Employee Recruitment Strategies for Success

Our Guides

- Sales & Marketing

- Finances

- Your Team

- Technology

- Social Media

- Security

Small Business Resources

Lead

- Best Business Phone Systems of 2024

- The Best PEOs of 2024

- RingCentral Review

- Nextiva Review

- Ooma Review

Our Recommendations

- Guide to Developing a Training Program for New Employees

- How Does 401(k) Matching Work for Employers?

- Why You Need to Create a Fantastic Workplace Culture

- 16 Cool Job Perks That Keep Employees Happy

- 7 Project Management Styles

Our Guides

- Leadership

- Women in Business

- Managing

- Strategy

- Personal Growth

Small Business Resources

Find

- Best Accounting Software and Invoice Generators of 2024

- Best Payroll Services for 2024

- Best POS Systems for 2024

- Best CRM Software of 2024

- Best Call Centers and Answering Services for Busineses for 2024

Our Recommendations

Online only. Expires 4/27/2024

How to Prepare an Income Statement

Table of Contents

In financial accounting — one of the most common types of accounting — many in-depth reports are fundamental, including the income statement. While your accounting software can generate these reports for you automatically, it’s still essential to understand what they are and what they signify. This way, you know how often to generate these reports, who should see them and why they matter so much. Read on to learn all about income statements.

What is an income statement?

An income statement is a financial report that shows all revenue and expenses of a company, department, team or operation over a set period. When generating these reports in your accounting software, you can select specific items to include or exclude based on client, payee, category or various tags.

Most accounting software also allows users to select the types of income and business expenses to be included. This ability helps managers customize reports to get the most accurate and insightful view of their company’s finances.

Income statements show revenue and expenses by category and include the organization’s net income (revenue minus expenses) over a set time. Thus, preparing an income statement involves compiling a list of revenue, expenses, losses and gains. Once these items are consolidated, they’re organized into categories and added to calculate net income over the period the statement covers.

When compiling an income statement, including the correct items and categories is crucial. Otherwise, business owners can’t get an accurate picture of a company, department or operation’s financial health for the period in question.

Income statements are accounting reports that show an organization’s revenue and expenses.

How to write an income statement

Income statements can be customized to suit the specific needs of a company, team, department or manager. That said, a general process of organizing revenue and expenses must be followed when preparing an income statement. Otherwise, managers aren’t guaranteed to compile the proper records in the correct format to provide insights into an organization’s profitability.

The four steps of writing an income statement are:

- Identify sources of revenue and gains (from investments, for example).

- Identify company expenses and losses incurred over the same period.

- Consolidate revenue, expenses, gains and losses by category, payee or another factor.

- Add revenue, expenses, gains and losses to determine the company’s net income for the covered period.

Most off-the-shelf accounting software allows users to easily generate income statements by simply selecting the type of accounting report they want to build and then identifying the revenue and expense categories they want to include or exclude from their report. [Related Read: Learn How to Create an Invoice]

What is included in an income statement?

An income statement includes all instances of money flowing into or out of a company (revenue and expenses) as well as instances of the company making or losing money without cash changing hands, such as the value of business assets rising or falling. Essentially, an income statement includes all items that, when added up, equate to a company’s net income over a set period.

The following are included in an income statement:

- Revenue by category

- Expenses by category

- Company gains on the value of assets

- Losses incurred over the same period

From this information, managers can use accounting software to calculate the net income for the time covered, which is also listed on the statement. Statements may also include intermittent totals at different points, such as operating revenue and income before taxes. Statements may also include net income as a percent of gross revenue (profit margin).

Several additional items are worth paying special attention to when preparing an income statement. Different companies handle these items differently and how they’re addressed will significantly affect the insights gleaned from an income statement:

- Interest expense

- Tax expenses

- Depreciation of property or equipment

- Amortization (write-downs in value) of business property

If these items sound familiar, it’s because they’re often singled out to be added back to net revenue. The resulting figure is called earnings before interest, taxes, depreciation and amortization (EBITDA) and is often considered a more accurate representation of a company’s profitability than its net income.

If you want to sell your business or pitch your business idea to potential investors, calculating your EBITDA can help you understand your company’s financial health and determine its valuation.

When and why are income statements used?

Company managers use income statements regularly for reporting purposes. Depending on a company or business owner’s circumstances, they can also be used to value a business or vet potential tax strategies to reduce your business tax liability.

Some other cases when income statements are used include:

- Reviewing company financials

- Making management decisions, such as hiring

- Contemplating investment in new assets

While income statements can be extremely helpful in many situations, they’re not typically used in other circumstances, which may surprise you. For example, income statements aren’t really necessary when filing taxes. Company owners or managers can use them to get a high-level view of how much they may owe, but tax filings are prepared using custom forms, not categorized income statements. Tax filings must be verified using third-party documentation, such as bank statements.

So, when preparing tax filings, accountants typically look directly at account statements instead of internal accounting reports like income statements.

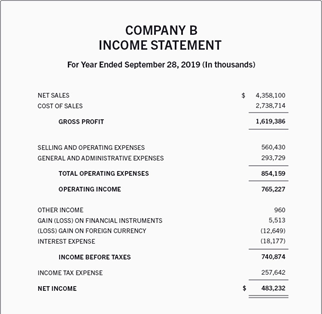

Example of an income statement

As seen in the example above, income statements begin by naming the company, team or department and the period the statement covers.

Next, income statements list the organization’s revenue and expenses for the period covered, followed by total operating income. Nonoperating revenue, gains and losses and interest expenses are then added in.

Once these items are added in, managers can see the company’s income before taxes. Then, there’s a line item for tax expenses before finally arriving at net income. This total represents the money made or lost over the period covered by the statement.

While many income statements list totals for each item included, specific items can also be broken out into further detail (revenue can be broken out by business line, for example) if doing so provides valuable insight to managers.

Income statement template

Free Download

Create an income statement in minutes using our free income statement template.

This income statement template may be helpful for manually assembling a report. However, if you have business accounting software, you likely won’t need it. Instead, you should be able to open your accounting software and generate a custom report that includes the items you want included in your calculations to determine net income for the period being reviewed.

The best accounting software for creating income statements

The best accounting software can help you generate accurate income statements effortlessly. Here are a few that we recommend for small businesses interested in choosing accounting software for essential needs like income statements:

- QuickBooks Online: With the leading name in accounting software, basic reports, including income statements, are available for all users. You can export your reports and add custom tags for smarter tracking and organization. Discover what else we like about this widely praised business technology via our QuickBooks Online review.

- Sage 50 Accounting: It takes mere seconds to generate basic and advanced reports in Sage 50 Accounting, including your income statement. We also like that the arrows between accounting tasks in Sage 50 point you from one step in your accounting workflow to the next. Check out our Sage 50 Accounting review to learn more about this platform.

- Xero: We like that Xero allows you to customize how you present your income statements. We also like that you can favorite income statements within Xero to quickly access these documents whenever you need them. Read our Xero review to learn more about this accounting platform’s reporting features.

- Zoho Books: You can use Zoho Books to create accounting reports, including income statements at any time. We like that you can add reports-only users to Zoho Books to securely share your income statements with whomever you please. Learn about Zoho Books’ refreshing breadth of features via our Zoho Books review.

- ZarMoney: When testing ZarMoney, we were pleased that, despite the platform’s comparatively advanced features, report generation was a breeze. We also liked how our income statements looked — they were clean and easy to understand. Explore ZarMoney’s reporting features and exceptional inventory management suite via our ZarMoney review.

Making a statement

Although income statements can be tedious to assemble manually, those days are over — the best accounting software makes the process a two-second affair. It also makes sharing your reports and understanding them effortless. Income statements have always been a necessity for smart business planning and with accounting software, creating them is among the fastest tasks on your list.

Dock Treece contributed to this article.