MENU

Start

- Best Small Business Loans for 2024

- Businessloans.com Review

- Biz2Credit Review

- SBG Funding Review

- Rapid Finance Review

Our Recommendations

- 26 Great Business Ideas for Entrepreneurs

- Startup Costs: How Much Cash Will You Need?

- How to Get a Bank Loan for Your Small Business

- Articles of Incorporation: What New Business Owners Should Know

- How to Choose the Best Legal Structure for Your Business

Our Guides

- Business Ideas

- Business Plans

- Startup Basics

- Startup Funding

- Franchising

- Success Stories

- Entrepreneurs

Small Business Resources

Grow

- The Best Credit Card Processors of 2024

- Clover Credit Card Processing Review

- Merchant One Review

- Stax Review

Our Recommendations

- How to Conduct a Market Analysis for Your Business

- Local Marketing Strategies for Success

- Tips for Hiring a Marketing Company

- Benefits of CRM Systems

- 10 Employee Recruitment Strategies for Success

Our Guides

- Sales & Marketing

- Finances

- Your Team

- Technology

- Social Media

- Security

Small Business Resources

Lead

- Best Business Phone Systems of 2024

- The Best PEOs of 2024

- RingCentral Review

- Nextiva Review

- Ooma Review

Our Recommendations

- Guide to Developing a Training Program for New Employees

- How Does 401(k) Matching Work for Employers?

- Why You Need to Create a Fantastic Workplace Culture

- 16 Cool Job Perks That Keep Employees Happy

- 7 Project Management Styles

Our Guides

- Leadership

- Women in Business

- Managing

- Strategy

- Personal Growth

Small Business Resources

Find

- Best Accounting Software and Invoice Generators of 2024

- Best Payroll Services for 2024

- Best POS Systems for 2024

- Best CRM Software of 2024

- Best Call Centers and Answering Services for Busineses for 2024

Our Recommendations

Online only. Expires 4/27/2024

FreshBooks vs. Xero: Comparing Top Accounting Software Platforms

Table of Contents

- FreshBooks and Xero are top-notch accounting software options that would work well for many businesses.

- FreshBooks excels at invoicing, expense management and basic financial reporting.

- Xero is good for bill pay, more advanced financial reporting and cost-effective scaling.

- This comparison is for small business owners choosing between FreshBooks and Xero for their accounting software.

Accounting software does more than track and organize your incoming and outgoing cash. The best accounting software platforms make it easier to pay vendors, receive customer payments, track expenses and much more. FreshBooks and Xero are excellent accounting software options whose features and focuses may make one or the other better for specific businesses.

We’ve gone through our FreshBooks review and Xero review to see how these two high-quality platforms perform against one another to help you choose the right accounting software for your organization’s needs.

FreshBooks vs. Xero Compared

Criteria | FreshBooks | Xero |

|---|---|---|

Pricing | Starts at $13.60 per month plus $11 per user per month | Starts at $15 per month; no additional fees per user |

Third-party integrations | Over 100, including Squarespace, Gusto, Gmail and HubSpot | Over 100, including Stripe, Gusto, Shopify, HubSpot and Mailchimp |

Invoicing tools |

|

|

Bill-pay features |

| Advanced tools for batch-scheduling bill payments |

Expense tracking |

| Automatic expense categorization, importing and reporting (highest tier only) |

Reporting |

| Several built-in reports with customizable layouts |

Who Do We Recommend FreshBooks For?

We recommend FreshBooks for all business customers that prioritize invoicing tools. Of all the accounting software platforms we reviewed, FreshBooks’ invoicing functionality impressed us the most. Creating invoices in FreshBooks is much easier than in other platforms ― automatic invoice generation and customization are a breeze. We especially like the fact that you can generate invoices from estimates and quotes in two clicks.

We also recommend FreshBooks for freelancers and very small teams. These user bases must carefully monitor expenses and FreshBooks provides high-quality tools at low prices. Plus, freelancers and very small service-based businesses live and die by invoices ― FreshBooks’ bread and butter.

Similarly, we recommend FreshBooks for small businesses in the early stages of growth. Given the platform’s pricing ― $13.60 per month plus $11 per user ― it remains relatively affordable in the early stages of building your team. Plus, FreshBooks offers over 100 integrations and a handful of reports you’ll likely find valuable as your business grows.

FreshBooks is notable because of the following factors:

- FreshBooks provides outstanding invoicing features.

- With an invoicing focus and competitive pricing, FreshBooks is suited ideally to freelancers and small teams.

- Freshbooks provides new and growing businesses with robust integrations and helpful reports at modest prices.

The FreshBooks app is considered among the best iPhone apps to get you through the workday, helping you create invoices, accept payments, track time and record expenses from your smartphone.

Who Do We Recommend Xero For?

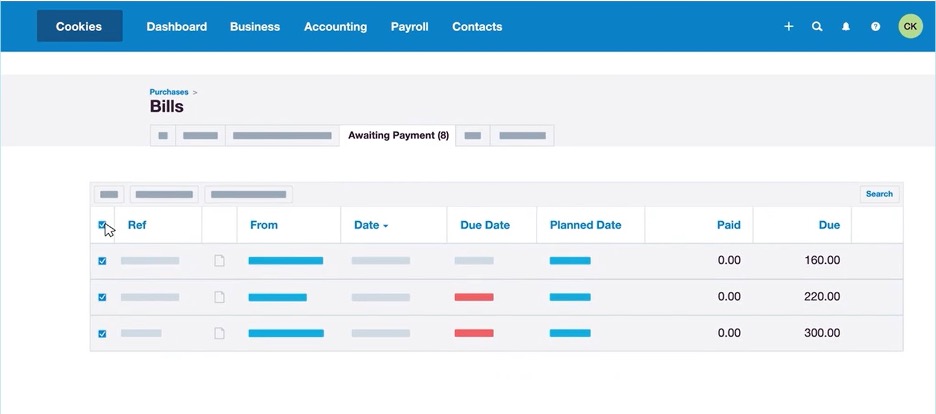

We recommend Xero for businesses looking to streamline their vendor payments, especially when you deal with many vendors. We have yet to encounter bill-pay tools as user-friendly and broad as Xero’s in any other accounting software platform we reviewed. We like how easy Xero makes it to batch-schedule advance payments to one or many vendors, removing late payment fees from your expenses.

We also recommend Xero for businesses that prioritize financial reporting tools in their accounting software. While Xero’s reporting suite isn’t as advanced as QuickBooks, it’s still noteworthy. We were especially impressed by Xero’s profitability tools. When you log into your Xero dashboard, you’ll immediately see your team’s expenses and tracked time. This feature makes it incredibly easy to see which inputs you might need to adjust to cut business expenses.

Xero is also an excellent fit if you want accounting software that suits your business at all growth stages. You get unlimited users no matter which Xero tier you opt into, and your subscription price won’t vary based on user numbers. You can jump from one tier to another whenever your business is ready, not when you hit an arbitrary user cap. Plus, with prices starting at $15 per month, Xero is affordable. The quality you get for the amount you spend is the essence of bang for your buck.

We found Xero’s accounting solution notable for the following reasons:

- With Xero, you can batch-schedule advance payments for one or many vendors.

- You’ll see profitability data immediately upon logging into Xero, making it easy to adjust your inputs to free up more cash for bill payments.

- Unlike many software providers, Xero doesn’t limit your user numbers or charge extra per user, making the platform highly scalable.

All Xero users get 24/7 online customer support. Additionally, canceling your account incurs no fees if you do so at least 30 days in advance.

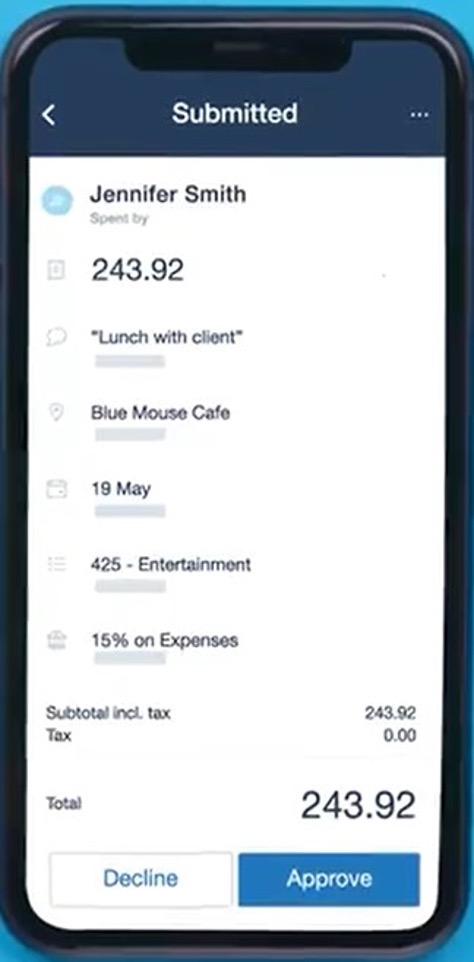

You can use Xero to pay all your vendor bills in just one click. Source: Xero

FreshBooks vs. Xero Comparison

Pricing

FreshBooks

FreshBooks has four pricing packages, though the base prices only comprise part of your payments. You’ll also pay an additional $11 per user per month. The Advanced Payments add-on for storing your clients’ payment details and automating recurring payments costs $20 monthly. Each transaction you make through this add-on will cost you 3.5 percent plus 30 cents every time a client makes a payment.

FreshBooks’ pricing packages are as follows:

- Lite: You pay $13.60 per month for your first year and $17 afterward. Lite gives you unlimited estimate and expensing tools; you can use Lite to send unlimited invoices to up to five clients. FreshBooks mobile app access, basic tax reporting and credit card and bank transfer client payments are also included.

- Plus: For your first year, Plus costs $24 per month, increasing to $30 after that. It includes all Lite features plus automatic expense tracking, receipt data capture and emailing. You can also add unlimited estimates and proposals while business health, accounting and financial reports become available in this tier as well. You also get accountant access, recurring client bills and retainers, mobile app mileage tracking and automated expense management. Plus also allows you to send invoices to up to 50 clients.

- Premium: This FreshBooks pricing tier costs $44 per month for your first year, increasing to $55 per month after that. You’ll get tools for tracking and paying your vendor bills alongside email customization, project profitability, late fee, checkout link and payment reminder features. Premium also eliminates caps on how many clients you can invoice.

- Select: This plan’s pricing is entirely customized ― FreshBooks will give you a quote that reflects your precise business needs. Select comes with a dedicated account manager, custom onboarding, premium phone-based customer support and data migration assistance. You’ll pay lower transaction fees and be able to immediately capture bill line items and securely accept credit card payments.

We like that FreshBooks’ base pricing is competitive. However, we found the add-on fee per user per month frustrating. This add-on cost needlessly inflated our costs when we tested the platform at larger team sizes. Nevertheless, for invoicing and automatic expense tracking, FreshBooks is a user-friendly option that still beats some other leading names on pricing.

Xero

Xero offers the following three pricing packages. Note that there are no per-user add-on fees:

- Early: This plan costs $15 per month, and you can send clients as many quotes as you’d like. You can also send clients up to 20 invoices monthly and add up to five monthly vendor bills. Additionally, the Early tier includes bank reconciliation, short-term cash flow and business snapshots and expense data capture.

- Growing: This plan costs $42 per month and eliminates all invoice and quote caps.

- Established: The Established plan costs $78 per month and introduces advanced analytics, multicurrency accounting, expense claiming and project tracking features.

We appreciate that Xero doesn’t charge extra fees per user. This kept our costs comparatively low as we tested the platform at different team sizes. We felt that each tier’s features justified its costs as did the automatically included (but optional) Gusto payroll integration. We’ve encountered few platforms that make it so easy and low-cost to automate your payroll accounting.

In our research, Gusto ranks among the best payroll services in the industry. Read our in-depth Gusto payroll review to learn about its features and pricing.

Winner: Xero

Although FreshBooks’ per-month subscription prices are lower, the per-user add-on fee only makes FreshBooks less expensive than Xero for very small teams. Plus, Xero offers a competitive feature set at every price point, making its value per dollar you spend better than with FreshBooks.

Third-party Integrations

FreshBooks

You can integrate over 100 third-party platforms with your FreshBooks account. These integrations include built-in connections with Squarespace, Gmail and HubSpot CRM, alongside third-party Dropbox and Expensify integrations. There’s also a Gusto integration, albeit via an add-on that incurs extra monthly fees. During our conversations with FreshBooks representatives, we were unable to obtain pricing for this add-on.

We were impressed with FreshBooks’ integrations. They were intuitive and connected our most vital platforms quite strongly.

Xero

Xero integrates with Stripe, HubSpot CRM, Mailchimp and Spotify. Additionally, as with FreshBooks, Xero includes a Gusto integration ― however, this integration doesn’t incur extra fees. Across the board, we found Xero’s built-in integrations ― and roughly 100 additional integrations ― to be approachable and powerful.

Winner: Xero

Xero barely beats FreshBooks when it comes to integrations. Both platforms offer approximately the same number of integrations and organize them neatly in their respective app stores. Additionally, we found both platforms’ integrations straightforward to use. However, we’ve chosen Xero as our winner since Xero’s Gusto payroll integration doesn’t incur additional fees.

Invoicing Tools

FreshBooks

When it comes to invoicing, there’s simply no better choice than FreshBooks:

- Single-screen invoicing: Every year that we’ve tested this platform, we’ve found its single-screen custom invoicing suite the most intuitive around. We like that all our invoicing work happens from one screen instead of having to constantly bounce between browser tabs.

- Easy invoice creation: It takes one click to send several invoices at once and automating recurring invoices is straightforward. Even if you prefer manual invoicing, FreshBooks streamlines the process of building new invoices from old ones.

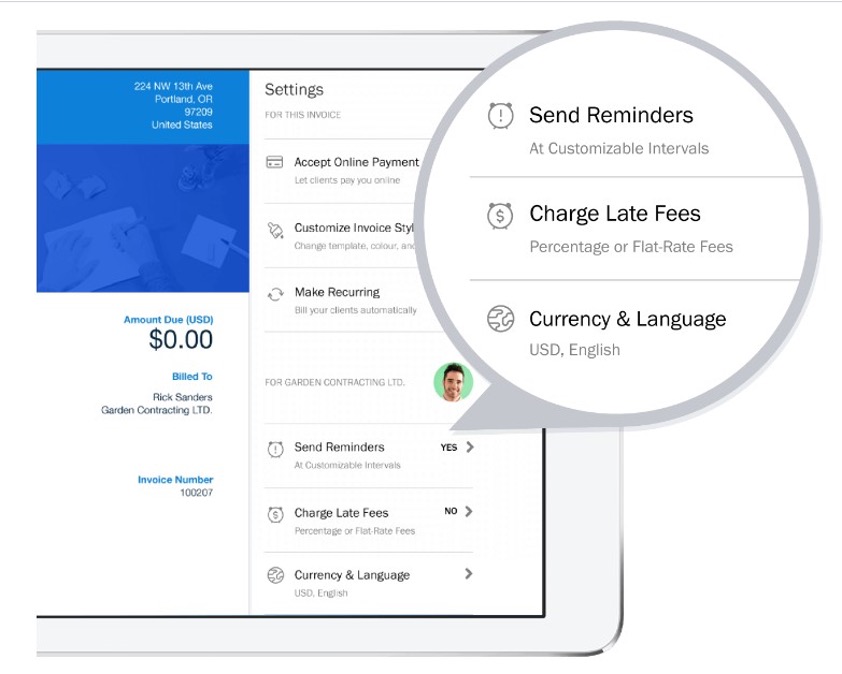

- Payment reminder tools: We also like FreshBooks’ highly user-friendly tools for reminding clients with outstanding invoices to pay. It’s as easy to send client reminders as to tack late fees onto overdue invoices.

- Easy client payments: Your clients can pay you right from your invoices via Apple Pay, Mastercard, Visa, Discover and automated clearing house. If you opt in to the Advanced Payments add-on, you can keep client card information on hand and set up subscription-like automated billing.

- Convert proposals and estimates to invoices: We were thrilled that you can convert proposals and estimates to invoices in only two clicks ― this level of streamlining is rare among accounting services.

- Additional tools: FreshBooks’ deposit request and early payment discount tools also impressed us highly.

In FreshBooks, charging late fees and sending payment reminders both happen from the same window. Source: FreshBooks

Xero

Overall, we were happy with Xero’s invoicing suite. However, we would’ve liked to see a bit more functionality:

- Invoice customization: With Xero’s invoicing suite, you can customize your invoices and view their payment status.

- Payment tools: You can also remind clients to pay, automate recurring invoices and offer one-click payments. However, your client payment methods are limited to just card or direct debit ― there’s no Apple Pay option as that is with FreshBooks.

- Mobile and desktop invoicing: You can invoice via the Xero mobile app or its desktop suite. On both versions of Xero, the invoicing tools are highly user-friendly, though not as user-friendly as FreshBooks.

- Convert quotes to invoices: You can convert quotes to invoices but not estimates while both are possible with FreshBooks.

Winner: FreshBooks

FreshBooks is superior to more than Xero when it comes to invoicing ― it’s also superior to all other accounting software platforms. If invoicing is your most significant need within accounting software, choose FreshBooks over Xero.

Bill Pay Features

FreshBooks

FreshBooks Premium and Select users get access to the FreshBooks bill pay suite, which we found useful but limited:

- Convert or create digital bills: We like that you can use FreshBooks to convert photos of bills into records within your accounting software. It took even less time to manually create digital bills in FreshBooks.

- Bulk-record payments: We also like that we could bulk-record our payments since FreshBooks only allows manual expense recording. Creating these records one by one would be tedious.

- No actual bill-paying functionality: Notably, FreshBooks only allowed us to track, record and organize our bill payments, not pay our bills. This disappointed us because many other accounting software services enable bill payment directly from the platform.

Xero

Unlike FreshBooks, Xero gives all users bill-pay tools, making it ideal for a business’s daily accounting activities. However, users on the Early tier can only send five bills per month:

- View purchase orders and expenses: With Xero, it’s exceptionally easy to see the status of due bills and pay them in bulk. We were impressed by how easily you can look over purchase orders and expenses.

- Bulk vendor payments: Our favorite Xero bill-pay feature is its bulk vendor payment suite. No other accounting software platform makes it so easy to batch-schedule an unlimited number of payments to one or many vendors. It truly takes just one click to pull this off, so you’ll have no trouble avoiding late payment fees and fully managing your accounts payable.

- Recurring payments: Xero is also a great pick if you need to automate recurring bill payments.

- Bill-pay organization: Xero helps you organize your bills and create billing reports, making it a powerful platform for making payments and analyzing cash outflow patterns.

Winner: Xero

Xero automates bill payments in bulk and across vendors, whereas FreshBooks only allows manual bill recording, not payment. We found Xero’s bill pay tools to be the best of any accounting software we reviewed ― not just when compared to FreshBooks. Choose Xero over FreshBooks if you want to organize and expedite your vendor payments.

Expense Tracking

FreshBooks

We like how neatly FreshBooks streamlined our fundamental expense management needs. The platform’s expense tools nearly rival those of QuickBooks, which offers one of the most powerful expense management suites around:

- Unlimited expense tracking: All FreshBooks users can track unlimited expenses.

- Automatic expense importing: The platform offers fully automatic expense importing and categorization, including mobile app mileage tracking.

- Additional expense-tracking tools: You can also scan receipts to create invoices and set certain expenses to recur automatically. Plus, we needed a few clicks to auto-generate expense reports and forward them to the accountant we’d invited to our FreshBooks account.

Any small business benefits from using QuickBooks for its accounting software. Read our QuickBooks review to learn why this platform is our pick for the best small business accounting software.

Xero

We were disappointed that all Xero expense tools are only available with the Established package, Xero’s priciest tier. These tools include the following:

- Import and categorize expenses: We found it easy to import and categorize our expenses automatically within the Xero expense management suite.

- Employee reimbursement: Xero allows you to directly reimburse employee expenses through the platform ― a feature FreshBooks lacks.

- Additional expense-tracking tools: Other features we like include receipt photo uploading, expense reporting and mobile app mileage tracking. However, FreshBooks has user-friendlier versions of these features.

Winner: FreshBooks

FreshBooks’ expense management tools are easier to use than Xero’s. They’re also available for all users, not only those who opt into the most expensive pricing plan. Choose FreshBooks over Xero for low-cost expense management tools.

Reporting

FreshBooks

We were satisfied with, but not enthused about, FreshBooks’ accounting reports. We found them helpful for understanding finance basics, but we wanted more information after running them. FreshBooks’ reports aren’t particularly customizable, so we could only review our data on the platform’s terms, not our own:

- Basic reporting: FreshBooks Lite offers basic tax and financial reports.

- Additional reports: Higher tiers introduce performance dashboards, business health reports and double-entry accounting reports. Sales tax summaries, accounts aging reports and profit and loss statements are also available.

Xero

Especially given its comparatively low prices, Xero impressed us when it came to all things reporting:

- Customizable report layouts: We like that Xero lets you customize the layouts of the platform’s many built-in interactive reports. Changing the appearance of our reports and interacting with the data streamlined our key performance indicator measurements.

- Compare budgets and actuals: Additionally, with Xero’s math formula tools, it was simple for us to look at our budgets and actuals side by side.

- Favorite reports: We especially like that Xero lets you favorite the reports you run most frequently. You can access your most-used reports nearly instantly after logging in. We also like that we could access profitability data and reports directly from the Xero dashboard without having to save them as favorites.

Winner: Xero

Xero offers more customizable reports than FreshBooks and makes accessing key financial data easier. We were impressed with Xero’s reporting suite compared to FreshBooks and when evaluated against many similarly priced competitors.

If financial reporting and enterprise resource planning are crucial for your business, Oracle NetSuite may be an ideal platform. Read our detailed Oracle NetSuite review to learn more.

FreshBooks vs. Xero Recap

Choose FreshBooks if:

- You want expense tracking and reporting fundamentals at low prices.

- You need the best possible invoicing features of any accounting software platform.

- You’re looking for basic reporting features at low costs rather than advanced reporting tools that can often be expensive.

Choose Xero if:

- You want somewhat advanced financial reports at prices that don’t break the bank.

- You need the best possible bulk vendor bill-pay tools of any accounting software service.

- You’re looking for accounting software that will grow with you at reasonable monthly subscription prices that don’t vary by team size.

FAQs

Xero and QuickBooks offer similar features at mostly similar prices. However, QuickBooks offers slightly more tools and a more intuitive user experience. Read our QuickBooks vs. Xero comparison to explore these platforms’ similarities and differences further.

Xero lacks tax tools for business users but operates a powerful tax platform for accountants. This combination of factors makes it worth hiring a certified public accountant if your business uses Xero as its accounting software.

FreshBooks is an ideal platform for freelancers because it excels at invoicing. However, it lacks quarterly tax calculation and payment tools. The FreshBooks reporting suite is also comparatively narrow. QuickBooks is an example of a platform that includes and builds upon features FreshBooks lacks. Learn more via our QuickBooks vs. FreshBooks comparison.

Yes. FreshBooks charges different payment processing fees for different payment methods. ACH transfers incur a 1 percent fee, although FreshBooks Select users may pay less. Visa, MasterCard and Discover payments incur a fee of 2.9 percent plus 30 cents per transaction. For American Express transactions, the fee is 3.5 percent plus 30 cents per transaction. This rate is also the fee for all card payments made via the FreshBooks Advanced Payments add-on.