MENU

Start

- Best Small Business Loans for 2024

- Businessloans.com Review

- Biz2Credit Review

- SBG Funding Review

- Rapid Finance Review

Our Recommendations

- 26 Great Business Ideas for Entrepreneurs

- Startup Costs: How Much Cash Will You Need?

- How to Get a Bank Loan for Your Small Business

- Articles of Incorporation: What New Business Owners Should Know

- How to Choose the Best Legal Structure for Your Business

Our Guides

- Business Ideas

- Business Plans

- Startup Basics

- Startup Funding

- Franchising

- Success Stories

- Entrepreneurs

Small Business Resources

Grow

- The Best Credit Card Processors of 2024

- Clover Credit Card Processing Review

- Merchant One Review

- Stax Review

Our Recommendations

- How to Conduct a Market Analysis for Your Business

- Local Marketing Strategies for Success

- Tips for Hiring a Marketing Company

- Benefits of CRM Systems

- 10 Employee Recruitment Strategies for Success

Our Guides

- Sales & Marketing

- Finances

- Your Team

- Technology

- Social Media

- Security

Small Business Resources

Lead

- Best Business Phone Systems of 2024

- The Best PEOs of 2024

- RingCentral Review

- Nextiva Review

- Ooma Review

Our Recommendations

- Guide to Developing a Training Program for New Employees

- How Does 401(k) Matching Work for Employers?

- Why You Need to Create a Fantastic Workplace Culture

- 16 Cool Job Perks That Keep Employees Happy

- 7 Project Management Styles

Our Guides

- Leadership

- Women in Business

- Managing

- Strategy

- Personal Growth

Small Business Resources

Find

- Best Accounting Software and Invoice Generators of 2024

- Best Payroll Services for 2024

- Best POS Systems for 2024

- Best CRM Software of 2024

- Best Call Centers and Answering Services for Busineses for 2024

Our Recommendations

Online only. Expires 4/27/2024

Crest Capital Review

Table of Contents

Crest Capital offers businesses flexible equipment financing options, low interest rates and fast funding, making it our choice for the best equipment financing loan provider for 2021.

- Small business owners often seek equipment financing to pay off the purchase of expensive equipment over a fixed period of time.

- Look for an equipment financing lender that will let you finance the total purchase, doesn’t charge exorbitant fees, and provides flexible and fixed repayment terms.

- Crest Capital offers 100% financing, a variety of financing and leasing options, and flexible terms. If you are borrowing $250,000 or less, you won’t have a complex application process.

- This review is for small business owners who are thinking about using Crest Capital to finance the purchase of business equipment.

Crest Capital provides small business owners with equipment financing ranging from $5,000 to $500,000. With fast funding, low interest rates and several equipment financing options, Crest Capital checks off all the boxes for a variety of small business borrowers. For these reasons, Crest Capital is our pick for the best alternative lender for equipment financing.

If you’re looking for financing review all of our small business loan best picks.

Crest Capital Editor's Rating:

7.3 / 10

- Collateral

- 5/10

- Online application

- 8/10

- Quick funding

- 10/10

- Credit requirements

- 3/10

- Variety of loan types

- 10/10

Cost

Because there are many types of startup financing structures with Crest Capital, it’s impossible to say what your interest rate would be. Those rates are determined by not only the structure you choose but also the term length, your credit score, your time in business and the type of equipment being financed.

Besides the interest rate, the only fee Crest Capital charges is a $250 documentation fee. If you decide to proceed with a loan from Crest Capital, the lender will collect the documentation fee and first month’s payment. Crest Capital then purchases the equipment from the vendor of your choice, and repayment is made monthly via automatic withdraw from your bank account.

There are no prepayment penalties; in fact, you may qualify for a discount on the remaining interest if you pay off the loan early. The variety of plans and agreement structures makes Crest Capital one of the most flexible equipment financiers we reviewed.

What made Crest Capital stand out from its competitors is that you can either take out a loan or lease the equipment. With a loan, you own the equipment at the end of the term. Crest offers different agreements, including the following:

- Equipment finance agreement: This is a fixed-rate loan with a monthly payment that does not fluctuate with Treasury rates. At the end of the term, you own the equipment.

- $1 purchase agreement: With this lease, you have a fixed monthly payment and you own the equipment at the end of the lease for a nominal amount, such as $1.

- 10% purchase option: This is a lease with a fixed monthly payment and a fixed purchase option. At the end of the lease, you can purchase the equipment at 10% of its original cost, renew the lease or return the equipment to Crest Capital.

- Fair market value: This agreement offers the lowest fixed monthly payments. In addition, the payments are usually 100% tax-deductible. At the end of the lease, you can purchase the equipment at fair market value, renew the lease or return it to Crest Capital.

- Guaranteed purchase agreement: This provides a guaranteed purchase price for the equipment at the end of the term. You can choose a purchase price that is fixed at a certain dollar amount or pick from a range between a fixed minimum and maximum amount.

- First-amendment lease: This agreement gives you a purchase option at one or more defined points during the lease, with the requirement that you renew or continue the lease if the purchase option is not exercised.

- Operating lease: This agreement meets the criteria established by the Financial Accounting Standards Board and is available for equipment with a strong aftermarket value. If you want to learn more about equipment leasing, check out our equipment leasing buyer’s guide.

The above financing structures can be combined with other payment options, including step-up plans (lower payments early in the finance term and higher payments later), deferred plans (deferred payment for up to six months) and seasonal plans (no monthly payments during seasonal businesses’ slow periods). The seasonal plans are especially attractive for businesses that use their equipment only during certain times of the year. This kind of flexibility was nonexistent at other lenders and is another reason Crest Capital is a great equipment financier for small businesses. SBG Funding offers equipment financing but not the same flexibility as Crest Capital.

Crest Capital offers Section 179 qualified financing, which allows tax deductions on the cost of equipment. Under Section 179, small businesses can deduct up to $500,000, with a threshold of $2 million for total equipment purchased for the year.

Crest Capital has some of the most flexible financing terms in the industry. It lets you finance 100% of the purchase of equipment and offers Section 179 qualified financing, which may allow you to deduct a large part of the purchase.

Applying for a Loan

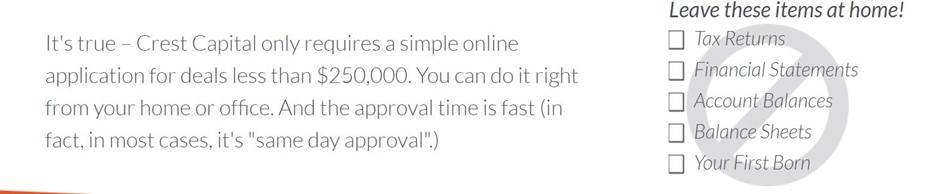

If you’re seeking financing for $250,000 or less, you fill out and submit a simple application. This easy process is ideal for business owners who are looking for quick funding. You have the option of filling out an application online or completing a paper version. The paper version can be faxed or scanned and emailed. The application includes basic questions about you, your business and the equipment you want to finance. Here is some of the specific information you must provide on the application:

- Company name, website and address

- Each company owner’s name and Social Security number

- Percentage of the company that belongs to each owner

- Company’s bank name and account number

- Estimated cost of the equipment

- Length of the loan or lease you want

- Condition of the equipment

- Name and address of the equipment vendor

To get approved for a Crest Capital loan, you need at least two years of business under your belt and a credit score of 650 or higher. You also can’t have a history of any delinquent payments or nonpayment with any other lenders.

Crest does a soft pull of your credit, so applying for a loan won’t affect your credit score.

Loan Terms

Crest Capital’s equipment financing terms range from 24 to 84 months. We like that wide range; some lenders let you finance equipment for only a short period of time.

Crest’s loans are secured by the equipment you’re financing, so no other collateral is required.

Helpful Tips

If your loan is for more than $250,000, Crest requires more documentation than the other lenders we reviewed; Balboa Capital is one that requires less documentation. For larger loans, Crest wants to see your financial statements, tax returns, loans, leases, other liabilities, a written overview of your business and an explanation of what the equipment is for.

Loans under $250,000 require much less documentation, and the process is less arduous. If the equipment financing loan is below $250,000, you don’t need to give Crest any financial statements.

Crest Capital Features

| 100% financing | Crest Capital will finance the total cost of your equipment. |

|---|---|

| Variety of terms | This lender offers a variety of equipment financing terms and will let you finance used equipment. |

| Minimal paperwork | Financing of less than $250,000 requires minimal documentation. |

100% Financing

When you work with Crest Capital, you can finance the total cost of the equipment purchase, so you can acquire the equipment without having to come up with any of the money upfront. Some equipment financing lenders don’t cover the full amount. For example, some lenders require you to make a 20% down payment, and then they provide financing for the other 80%.

Variety of Terms

Crest Capital is among the most flexible equipment financiers we reviewed. The wide variety of loan and lease options ensures you can choose the financing option that works the best for your business.

Crest Capital also lets you finance used equipment and offers Section 179 qualified financing, which allows tax deductions on the cost of equipment. Being able to deduct the cost of the equipment from your taxes helps make equipment financing even more attractive to borrowers. [Related Content: The Pros and Cons of a Term Loan]

Minimal Paperwork

If you are financing equipment for less than $250,000, Crest offers an easy application, fast approval and quick funding times. This lender doesn’t require a lot of documentation to approve a loan, unless it’s over $250,000. You just fill out a simple application that asks for basic information about you and the equipment being financed.

However, a much more extensive application process is required for financing in excess of $250,000. In these instances, you must provide bank statements, tax returns and a detailed explanation of how the equipment will be used.

Customer Service

Crest Capital provides customer service by phone and email during normal business hours. The company has an online calculator to help you determine how much your monthly payments will be.

Crest Capital has been providing small businesses with funding since 1989. The company has an A+ rating with the Better Business Bureau and has been accredited since 2012.

Crest Capital has been providing funding to small businesses for more than three decades.

Drawbacks

The biggest drawbacks of Crest Capital are the minimum credit score of 650 and the minimum time in business of two years. Those two requirements might eliminate some businesses from being considered for financing. In addition, the company doesn’t work with startups. Another downside is the $250 documentation fee.

Summary

Crest Capital is our best pick for equipment financing because of its 100% financing, easy application process and competitive rates.

We recommend Crest Capital for:

- Businesses that do not want to put a down payment when financing equipment

- Borrowers who are looking to finance $250,000 or less and want a simple application and approval process

We DON’T recommend Crest Capital for:

- Those with credit scores under 650

- Those who have been in business for less than two years